This page documents what is POSSIBLE to achieve with short term trade scalping.

First are the month's statistic worksheets followed by the daily trades.

************************************************************************

Profitable - stats are looking better, closer to "normal". Need improvement in Ave.Tick Gain

Profitable - stats are looking better, closer to "normal". Need improvement in Ave.Tick Gain

October 2017 trades

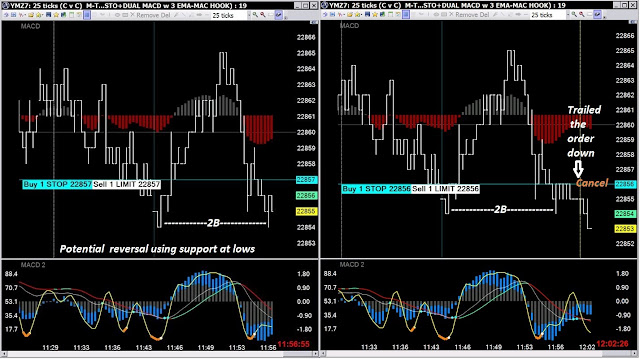

The charts below are my daily trades for the entire month.

The tick Gain/Loss numbers and net dollar amounts have been adjusted to show just 1 contract for each trade.

The combined charts have 1) entry rationals, 2) results and 3) what happened after the trade was closed.

Every break-even trade may not be shown but they do get included in my end-of-month statistics.

The tick Gain/Loss numbers and net dollar amounts have been adjusted to show just 1 contract for each trade.

The combined charts have 1) entry rationals, 2) results and 3) what happened after the trade was closed.

Every break-even trade may not be shown but they do get included in my end-of-month statistics.

After commission trading results are listed above the 1st chart of each session:

Date / day ... Winning / Losing / Break-even ... Gross tick Gain/Loss or Net Dollar amount

10/31/2017 Tuesday...5/2/0...+28 or+$98

10/30/2017 Monday...3/2/1...+24 or +$84

10/29/2017 Sunday night

10/27/2017 Friday...3/1/0...+18 or +$51

10/26/2017 Thursday night

Back to...

10/26/2017 Thursday...2/0/0...+18 or +$78

10/25/2017 Wednesday night

10/25/2017 Wednesday...4/0/0...+26 OR +$106

10/24/2017 Tuesday...3/0/0...+23 or+$97

10/23/2017 Monday...0/2/0...-4 or -$32

10/20/2017 Friday...4/5/0...+5 or -$1

10/19/2017 Thursday night

10/19/2017 Thursday...5/1/1...+41 or +$183

10/18/2017 Wednesday night

10/18/2017 Wednesday...3/0/0...+55 or+$257

Has been awhile since I caught a runner...

AND ANOTHER!

10/17/2017 Tuesday...2/1/0...+8 or +$22

10/16/2017 Monday...3/1/0...+20 or +$80

10/13/2017 Friday...3/1/0...+16 or +$66

10/12/2017 Thursday...0/1/0...-2 or -$16

10/11/2017 Wednesday...4/0/1...+29 or +$115

10/10/2017 Tuesday...1/1/1...0 or -$18

10/09/2017 Monday...2/1/1...+17 or +$61

10/06/2017 Friday...2/0/1...+19 or +$77

10/05/2017 Thursday night

10/05/2017 Thursday...3/2/1...+11 or+$25

10/04/2017 Wednesday...2/2/0...+10 or+$16

10/03/2017 Tuesday night

10/03/2017 Tuesday...2/2/0...+17 or +$73

10/02/2017 Monday...4/1/0...+27 or +$110

10/01/2017 Sunday night

10/31/2017 Tuesday...5/2/0...+28 or

10/30/2017 Monday...3/2/1...+24 or +$84

10/29/2017 Sunday night

10/27/2017 Friday...3/1/0...+18 or +$51

10/26/2017 Thursday night

Back to...

...Back

10/26/2017 Thursday...2/0/0...+18 or +$78

10/25/2017 Wednesday night

10/25/2017 Wednesday...4/0/0...+26 OR +$106

10/24/2017 Tuesday...3/0/0...+23 or

10/23/2017 Monday...0/2/0...-4 or -$32

10/20/2017 Friday...4/5/0...+5 or -$1

10/19/2017 Thursday night

10/19/2017 Thursday...5/1/1...+41 or +$183

10/18/2017 Wednesday night

10/18/2017 Wednesday...3/0/0...+55 or

Has been awhile since I caught a runner...

AND ANOTHER!

10/17/2017 Tuesday...2/1/0...+8 or +$22

10/16/2017 Monday...3/1/0...+20 or +$80

10/13/2017 Friday...3/1/0...+16 or +$66

10/12/2017 Thursday...0/1/0...-2 or -$16

10/11/2017 Wednesday...4/0/1...+29 or +$115

A longer term chart showing the trade above...The TRIXh , MACDh and MACD-EMA were

printing Divergences while STO was in a position to SLING -- reversing price direction

10/10/2017 Tuesday...1/1/1...0 or -$18

10/09/2017 Monday...2/1/1...+17 or +$61

10/06/2017 Friday...2/0/1...+19 or +$77

10/05/2017 Thursday night

10/05/2017 Thursday...3/2/1...+11 or

10/04/2017 Wednesday...2/2/0...+10 or

10/03/2017 Tuesday night

10/03/2017 Tuesday...2/2/0...+17 or +$73

10/02/2017 Monday...4/1/0...+27 or +$110

TEST TRADE -- I just don't like to short