MACD is for TREND...stochastic tells you WHEN

Potential trade opportunities for the dates noted ... may include

1) Entry + rationals 2) Results and often 3) What occurred afterward

The "test" trades are listed under the Session Separators

A Simple method:

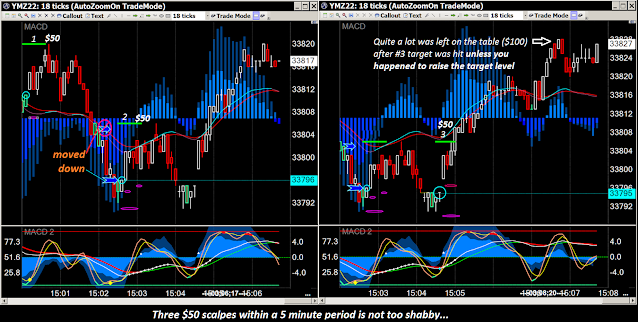

Keep stops very tight but raise the Targets.

Potential trades :

02/21/24 Wednesday

01/19/24 Friday

01/10/24 Wednesday

01/08/23 Monday

01/07/23 Sunday night

12/22/23 Friday

12/20/23 Wednesday night

12/18/23 Monday night

12/17/23 Sunday night

12/13/23 Wednesday night

12/11/23 Monday night

11/27/23 Monday

Friday 11/17/23 Friday

The MACD TURN set-up:

Sunday night 11/12/23

Friday 11/10/23

11/6/23 Monday

11/01/23 Wednesday

10/31/23 Tuesday night

10/30/23 Monday

Price to indicator divergence

10/27/23 Friday

10/26/23 Thursday

10/23/23 Monday

10/22/23 Sunday night

10/19/23 Thursday

10/13/23 Friday

10/12/23 Pre-MMO trades

10/11/23

Trail a Buy Stop manually using a fixed Stop Loss

10/09/23 Monday

09/25/23 Tuesday

09/25/23 Monday

09/22/23 Friday

09/21/23 Thursday

09/20/23 Wednesday

09/19/23 Monday

09/15/23 Friday

09/12/23 Tuesday

09/07/23 Thursday

Three trades +6 points with less than 4 points of draw-down after entry and 1 break-even trade...

|

| Another example of the Stochastic Hook entry signal (orange bar on price and yellow diamond on stochastic) |

09/06/23 Wednesday

09/05/23 Tuesday

You cannot know which sessions will be conducive for using this methodology

but generally it works more often than it doesn't...

09/01/23 Friday

08/31/23 Thursday

08/30/23 Wednesday

08/30/23 Tuesday

08/24/23 Thursday

08/22/23 Tuesday

08/21/23 Monday night

08/20/23 Sunday night

08/18/23 Friday

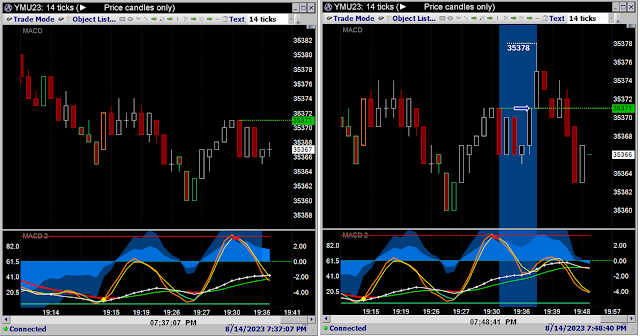

08/14/23 Monday night

08/9/23 Wednesday

08/08/23 Tuesday

08/07/23 Monday night

8/03/23 Thursday night

8/03/Thursday - Buy-stop opportunities

8/01/23 Tuesday - Stochastic buy opportunities:

|

| They don't ALWAYS work |

7/31/23 Monday

7/30/23 Sunday night

07/27/23 Thursday

|

| 1:56 PM +11 |

07/26/23 Wednesday

|

| 2:45 PM +7 |

|

| 12:09 PM +3 |

|

| 7:28 AM +4 |

07/24/23 Monday

|

| 2:00 pm |

|

| 1:48 PM |

|

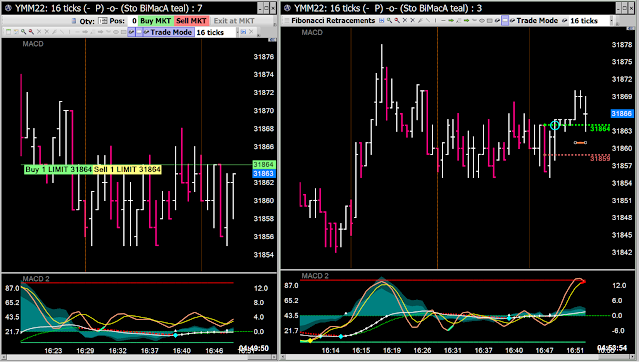

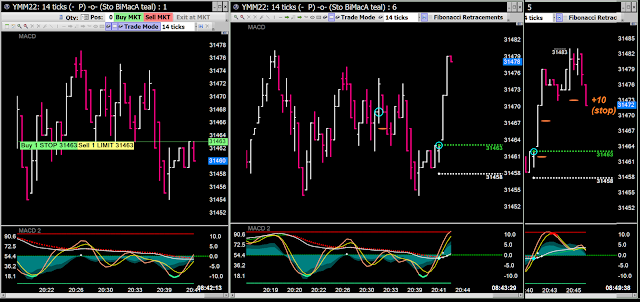

| 8:43-8:55 AM |

07/19/23 Wednesday

07/18/23 Tuesday

07/17/23 Monday

07/10/23 Monday

07/06/23 Thursday night

07/06/23 Thursday

06/29/23 Thursday

06/27 thru 06/28

06/22/23 Thursday

Wednesday night

...........

06/21/23 Wednesday

06/19/23 Monday night

06/18/23 Sunday night

06/13/23 Tuesday

06/12/23 Monday

06/09/23 Friday

Testing the market using 5 point target and 4 point trail stop

brackets with Buy-Stop order entry above Signals

06/05/23 Monday

06/01/23 Thursday

05/26/23 Friday Momentum scalps

05/25/23 Thursday

05/22/23 Monday

05/21/23 Sunday night

05/16/23 Tuesday

05/04/2 Thursday

05/03/23 Wednesday

05/02/23 Tuesday

04/30/23 Sun night

04/25/23 Tuesday

04/24/23 Monday

Sunday night 04/22/23

04/18/23 Tuesday

04/17/23 Monday

04/10/23 Monday

04/05/23 Thursday

04/05/23 Wednesday

04/04/23 Tues

04/03/23 Mon

04/02/23 Sun night

03/30/23 Fri morn

03/29/23 Wed night

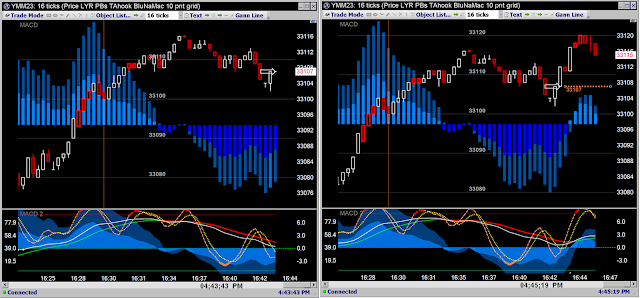

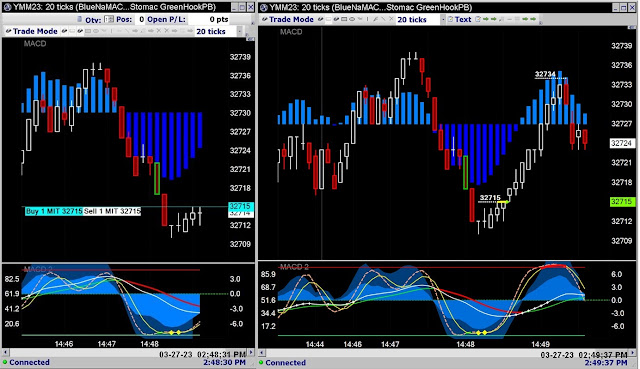

03/27/23 Mon night

03/21/23 Wed night

03/17/23 Fri

03/16/23 Thurs

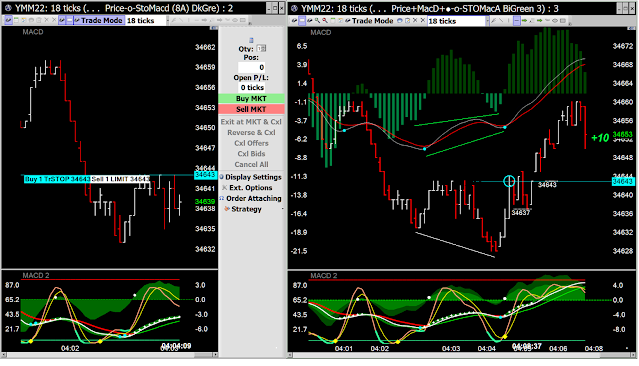

I hate it when I just miss a great run

03/14/23 Tues

Brackets used today - 7 point Target & 4 point trailing Stop

03/13/23 Monday

03/10/23 Friday

03/09/23 Thur

03/08/23 Wed

03/06/23 Monday

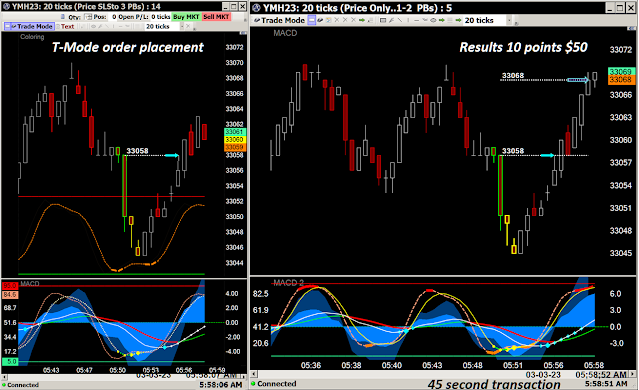

03/03/23 Friday

Trailing Stops

03/02/23 Thursday

02/28/23 Tuesday

02/16/23 Thursday

02/15/23 Wednesday

02/14/23 Tuesday

02/13/23 Monday

02/10/23 Friday

02/09/23 Thursday

02/07/23 Tuesday

02/06/23 Monday

02/05/23 Sunday night (Monday's session)

02/01/23 Thursday

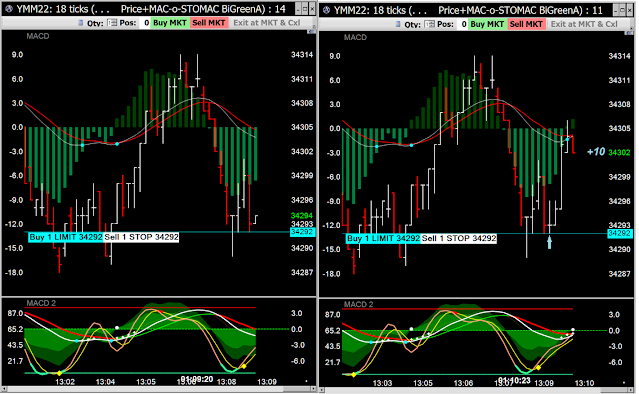

Two 10 point runs back to back

02/01/23 Wednesday

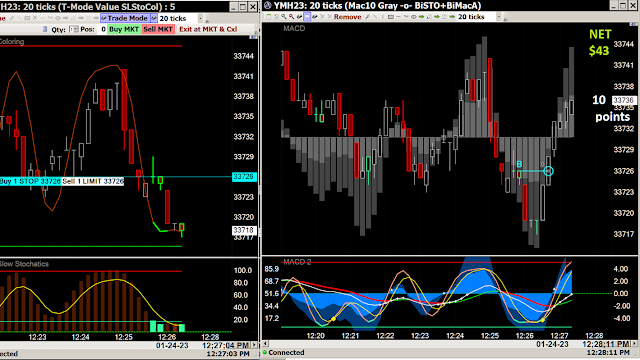

01/24/23 Monday

01/23/23 Monday night

01/22/23 Sunday night

01/12/23 Thursday

01/10/23 Tuesday

01/06/23 Friday

01/03/23 Wednesday

01/03/23 Tuesday

just a little late

12/29/22 Thursday

Net $33

Net $33

12/28/22 Wednesday

12/27/22 Tuesday

12/26/22 Monday night

12/21/22 Wednesday

12/20/22 Tuesday night

12/20/22 Tuesday

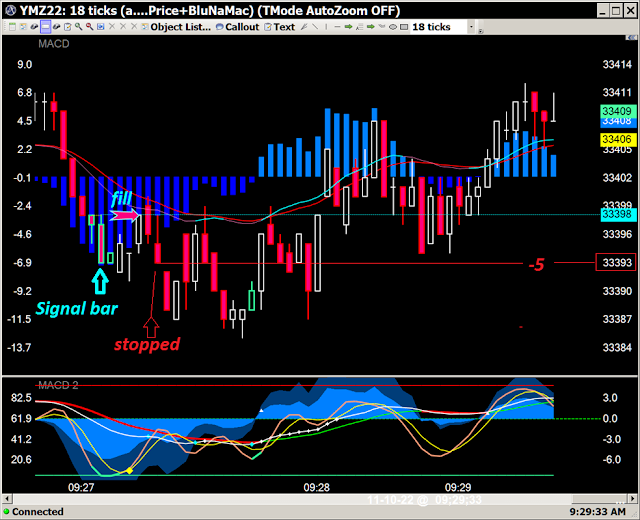

Signal Bar scalps working in today's session

12/19/22 Monday

12/18/22 Sunday night

Nice runner:

12/15/22 Thurs

12/13/22 Tuesday

12/12/22 Monday

Market's Mood has changed - might be time to modify Brackets

12/11/22 Sunday night

12/09/22 Friday

Take bits-and-pieces out at a time - can do this all day long

12/08/22 Thursday

12/06/22 Tuesday

12/05/22 Monday

12/01/22 Thursday

11/29/22 Tues night (Wed's session)

11/29/22 Tuesday

A 3-fer

Most days there's plenty of good trades for the taking

11/28/22 Monday night

11/27/22 Sunday night

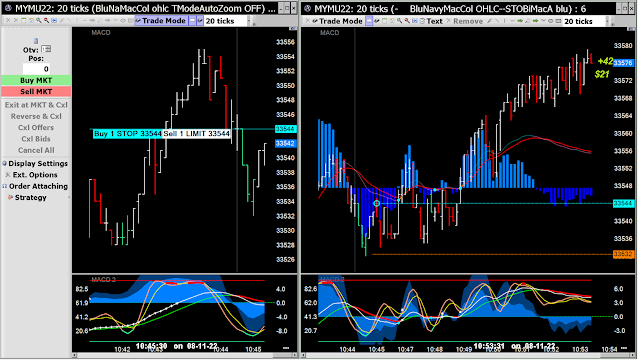

New T-mode layout using 5 point trailing stop with 10 point target

11/24/22 Thursday...Thanksgiving early close

Minimize stop out losses

11/23/22 Wednesday

11/17/22 Thursday

11/16/22 Wednesday

11/15/22 Tuesday

"ya gotta be in to win"

11/14/22 Monday

|

| +$106 |

11/11/22 Friday

A time frame comparison

11/10/22 Thursday

I win some and get stopped often...one win covers two stop-losses on average days.But over the longer term with some better days :

more wins than stop-losses provides the net gains.

11/8/22 Tuesday

11/7/22 Monday

11/3/22 Thursday

11/02/22 Wednesday Signalbar frequency

11/01/22 Tuesday

10/31/22 Monday

10/25/22 Tuesday

10/19/22 Wednesday

Some Micro bits-and-pieces

10/11/22 Tuesday

2-fer

10/10/22 Monday

10/06/22 Thursday

...Blogger would not upload charts 10/6/22...was able to upload them on 10/7/22...

10/05/22 Wednesday

10/04/22 Tuesday

A break-even after commission is better than a loss

10/03/22 Monday

9/30/22 Friday

$100 per hour --- A little over an hour and 4 winning trades were presented with little or no draw-down:

9/29/22 Thursday

The 1-2 Punch indicator pattern with price SIGNAL

Again the 1-2 Punch indicator pattern with price SIGNAL

,,,bits and pieces at a time...

Be quick to cancel when SIGNALs fail to get a fill and don't run up immediately9/28/22 Wednesday

Buy Stop orders limit the downside while you're looking for upside

9/27/22 Tuesday

09/14/22 Wednesday

09/08/22

09/07/22 Evening session

09/07/22

Waiting a bit after signals print...

Buy Stop orders placed at or above current price more often gets you in

when price is moving in a favorable direction and keeps you out when it's not

which minimizes potential draw-down

09/06/22

08/31/22

08/25/22

08/24/22 Wednesday

08/23/22 Tuesday

08/16/22 Friday

...sometimes they run...

08/11/22 Thursday

08/09/22 Tuesday

...

08/08/22 Monday night

+15...$75

'Coulda shoulda' on the trade above

+12...$60

08/08/22 Monday

-5 points...stopped

2 trades ... a break-even and a miss

Always get filled when using Buy-Stop orders

08/05/22 Friday

Quick scalps work best at times...

08/04/22 Thursday night

+10 short

+12...$60

08/04/22 Thursday

08/03/22 Wednesday night

20 pts $100

08/03/22 Wednesday

20 pts $100

08/02/22 Tuesday

08;55;24 AM on 08-02-22 20 pts $100

08/01/22 Monday

12;33;16 PM on 08-01-22 +7 $35

11;51;23 AM on 08-01-22 +8 $40

07/31/22 Sunday night

5 point STOP ... 12 point TARGET

07/28/22 Thursday

E-mini DOW 30 net $53

Micro DOW 30 net $8.50

07/26/22 Tuesday

no fill -cancel buy order

07/25/22 Monday

Trailing the order entry down results in 26 points max ($130)

07/22/22 Friday

Hunting runners methodology

07/21/22 Thursday

16 to 44 points ($80 to $220)

26 points ($60 to $130)

07/20/22 Wednesday

20 pts...$100

42 pts...$210

07/19/22 Tuesday night for Wednesday

Practice trades - get a feel for how they're running:

07/19/22 Tuesday

Strong up days are usually more profitable than otherwise ...

The DOW 30 are up 671 points at 3:35 pm

07/18/22 Monday

07/17/22 Sunday night

...sometimes the bear eats you...

...sometimes you eat the bear ...

07/13/22 Wednesday

07/12/22 Tuesday

07/11/22 Monday

Micro E-Mini DOW ... why bother?

07/06/22 Thursday

01;05;53 PM on 07-06-22 2.4 points net $7 Micro RUT

06;48;25 AM on 07-06-22 stopped -5 ...e-mini YM

04;44;10 AM Micro YM net $5

|

| 3 after............................................2 exit...............................1 order entry |

07/05/22 Tuesday

07/01/22 Friday

01;22;56 PM net $21

06/28/22 Tuesday's session

02;16;37 PM +17 points__

06/27/22 Monday's session

4;05;54 PM +12 points__

02;33;14 PM +18 points__

12;59;32 PM +13 points__

06/24/22 Friday's session

01;00;31 PM on 06-24-22 missed fill

09;14;43 AM on 06-24-22 +35 points

08;31;00 AM on 06-24-22 -7 points

06/23/22 Thursday night

06;33;32 PM on 06-23-22 +$10.50

06/21/22 Tuesday's session

...

06/20/22 Monday night

09;13;40 PM on 06-20-22 stopped

06/20/22 Monday's session

...

06/19/22 Sunday night

07;16;25 PM on 06-19-22 stopped_

06/17/22 Friday's session

04;00;28 PM on 06-17-22 $100 run

11;14;15 AM on 06-17-22 +$19 net__

06/16/22 Thursday's session

02;58;45 PM on 06-16-22 +$91

12;37;51 PM on 06-16-22 $21

06/15/22 Wednesday's session

05;40;53 AM on 06-15-22 MYM + $12

06/14/22 Tuesday's session

03;21;03 PM on 06-14-22 20 points

02;57;51 PM on 06-14-22 -5 stopped

02;34;37 PM on 06-14-22 +12 points

06/13/22 Monday night

07;27;00 PM +4 points

06/09/22 Monsday's session

04;18;48 PM stopped -$25__

01;28;43 PM DIV STO 1-2 punch $110 __

06/09/22 Thuresday's session

...

06/08/22 Wednesday night

08;20;58 PM on 06-08-22 18 points

06/08/22 Wednesday's session

...

06/08/22 Tuesday night

06;53;01 PM on 06-07-22 +8 points

05/27/22 Tuesday's session

01;19;24 PM on 05-31-22 +12 points

05/27/22 Friday's session

07;32;59 AM on 05-27-22 stopped -2

05/26/22 Thursday night session

08;46;46 PM on 05-26-22 +$65

05/26/22 Thursday's session

...

05/25/22 Wednesday night

04;16;09 PM on 05-25-22 6 points

Not terrific - Pretty much the action that I took all day...I kept missing them, as is shown 5 minutes before this one

05/24/22 Tuesday's session

...

05/23/22 Monday night

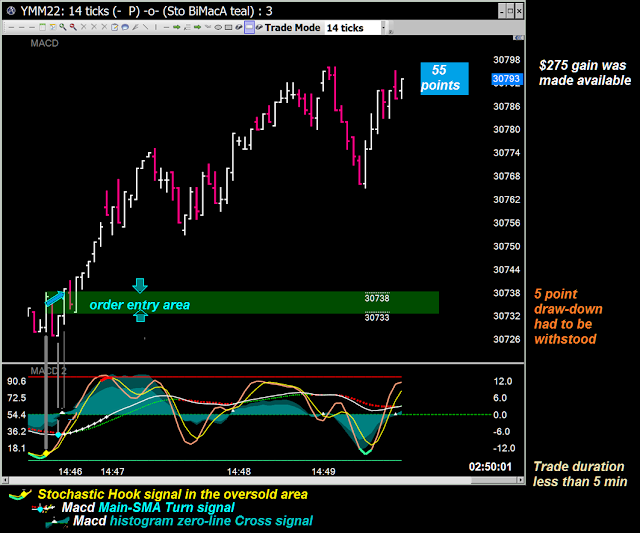

07;34;03 PM on 05-23-22 $255

05/23/22 Monday's session

2 quick in-n'-outs to test the market

05/22/22 Sunday night

Strategy - using a Buy stop entry with a 5 point initial stop, then changing to trailing

the stop 10 points behind the highs looking to catch a multi-hundred dollar runner...

09;21;06 PM on 05-22-22 stopped -3

08;42;13 PM on 05-22-22 +10 (trailed stop)

05/20/22 Friday's session

09;20;22 AM on 05-20-22 12 points $60 gross, $53 net

05/19/22 Thursday's session

12;35;55 PM on 05-19-22...stopped -$25 gross, -$32 net

05/18/22 Wednesday's session

05/17/22 Tuesday's session

09;52;28 AM on 05-17-22

05/16/22 Monday's session

04;25;37 PM on 05-16-22

05/12/22 Thursday's session

07;27;17 AM on 05-12-22

05/11/22 Wednesday's session

11;36;46 AM on 05-11-22

05/09/22 Monday's session

07;52;57 PM on 05-08-22

05/06/22 Friday's session

06;25;58 PM on 05-05-22

04;15;08 PM on 05-05-22

05/05/22 Thursday

01;18;15 PM...$250 in seconds

Wednesday night 07;20;38 PM...-3 stopped

05/04/22 Wednesday

Tuesday night 07;09;39 PM...14 points

05/03/22 Tuesday

04;35;09 PM...12 points

Monday night 08;26;33 PM...12 points

Monday night 07;02;28 PM...12 points

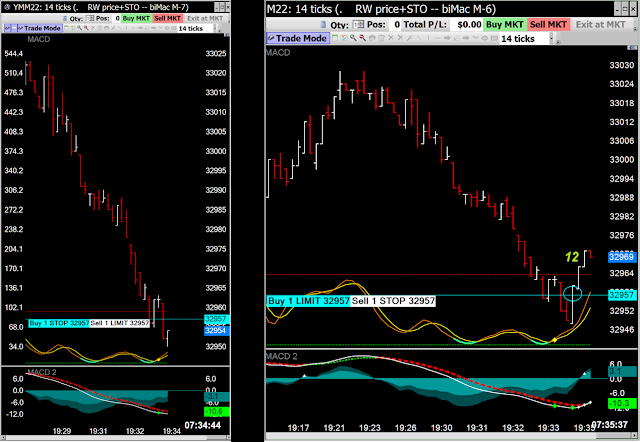

05/01/22 Sun night 07;34;44 PM...12 points

05;35;31 AM...12 point target $60

01;23;23 PM...12 points

09;02;18 AM...+12 points or $60

Monday night 04/25/22

08;14;08 PM...+14 points $70

04/20/22 Wed night 06;32;33 PM...no fill

07;11;40 AM...-5 stopped

04/19/22 Tuesday night 08;20;38 PM...20 points

04/19/22 Tuesday night 07;03;44 PM...-5 stopped

04/18/22 Monday night 08;09;51 PM...12 points...$60

04/18/22 Monday night 06;55;52 PM...12 points...$60

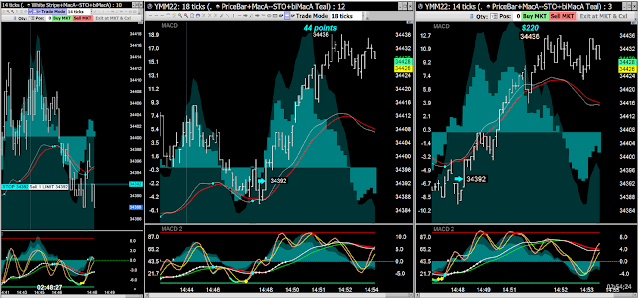

02;48;27 PM...44 points $220 was available for the taking

10;55;28 AM...15 points

09;06;38 AM...+30 points

08;58;40 AM...no fill

08;52;35 AM...no fill

08;43;54 AM...-5

02;51;51 PM...+6 ... can't always rake it in big

03;15;42 PM...+34-40 and sometimes you get to eat the bear

25 minutes after the opportunity shown above:

03;59;43 PM...30 points + within seconds - very difficult to even get an order placed

07;21;13 PM...3 points gross nets $13 after commish

04;10;11 PM...$190 ...I missed it!

11;58;13 AM... -$25 -5 Stopped

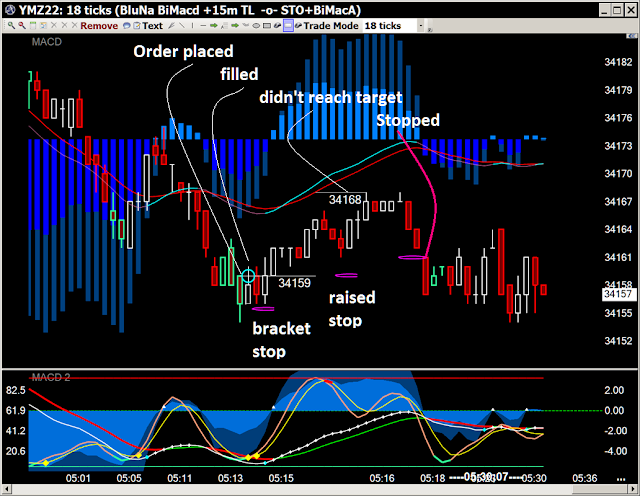

Did not raise the stop order - was giving it every chance to hit

the initial target but ended up costing me extra $$$ in losses.

03;11;37 PM...$100

03;05;57 PM...$100

05;16;34 AM...missed entry

01;38;17 PM...+12 $60 0 draw-down

01;09;20 PM...+10 points $50 0 draw-down

Apply Trailing Stop to your bracket orders... -$25 vs -$10

04;04;09 AM...10 points $50 ...$35 draw-down

First spotted the potential entry pattern on the 256 tick chart:

04/03/22 Sun night

06;16;35 PM...-7 net $-35 ...2 trades

8;47;03 AM...-$25 stopped

07;01;04 AM...$100 missed opportunity

08;12;02 PM... BE

12;54;35 PM...+7 $35 ...$10 max draw-down ...

...ya don't always make a killin' when buying the dips...

so you take out what you can until you can see what's happening

11;31;42 AM...-5 stopped -$25 could have been -1 -$5

Buy the dips BUT also manage the trade to minimize STOP losses

12;10;05 PM...-5 stopped -$25

11;05;14 AM...+16 $80 ...$0 draw-down

09;36;18 AM...+10 $50 ...$15 maximum draw-down

To use STOPs or not to use STOPS -- that is the question

How much draw-down are you comfortable with? Price could just as easily gone down as much as it went up.

You've got to ask yourself a question - - Do you feel lucky?

10;01;43 AM...+22 points = $110 ...$10 maximum draw-down

Signals used for the entry above :

Macd Histogram shows divergence to price and is rising...

Macd Fast Moving Ave has turned up (lime diamond printed on the line)...

SlowSTO is oversold (lime coloring)...both stochastic lines have

turned up and a STO TA Hook has printed (yellow diamond)

08;38;35 PM...+19 points $95 ...$0 draw-down

03;42;36 PM...16 points $80 ...$0 draw-down

08;17;07 AM...+11 points...Exit at Mkt & Cxl for +11...$55 ...$25 draw-down

03/20/22 Sun night

07;52;17 PM...+15 max...Exit at Mkt & Cxl for +11...$55 ...zero draw-down

Arrows show the entry and initial STOP, red dashes are raised stops

02;11;56 PM...20 points..$100 ...6 point draw-down

01;13;08 PM...+12 $60 ...zero draw-down

Thursday night 07;14;49 PM...BE...

03;50;50 PM...+12 max with zero draw-down on entry

11;29;20 AM...+34 points for #2...$170...$0 draw-down

06;43;12 AM...$85 ...$0 draw-down

02;18;39 PM...$60 .....$0 draw-down

11;13;10 AM....$60 .....$15 draw-down

03;38;53 PM...$140...$15 draw-down

AND WHAT HAPPENED AFTER !

03;09;26 PM...$125 max...$50 draw-down

11;52;13 PM...+75...only $15 draw-down

+8 max...12;24;31 PM...-10 via raised Stop

+14...09;27;24 AM...$70...($10 draw-down)

9 points maximum...08;44;57 AM...-$10...Stopped

+17 points...03;02;14 PM...$85 max ... $30 draw-down

+12 points...06;00;39 AM...$60 run...($10 draw-down)

+12 points...01;42;19 PM...$60 run...($5 draw-down)

+22 points...04;58;51 AM $110 with zero draw-down

$100...(6)...07;56;38 AM $100 became available...($30 draw-down)

+42...(4)...08;40;04 PM over $200 became available

10...(0)...04;08;39 PM $50 in-and-out in 46 seconds

10...(0)...01;20;41 PM $50 in-and-out in 11 seconds

(brackets - 10 point target 4 point stop)

3 points max...(BE)...04;41;15 PM $-7 (commish)

5 max...(3)...06;14;59 PM ($22 stopped)

8 max...(BE)...04;08;08 PM Break- even

"Why" you control your STOPs - move them up ASAP

10...(0)...04;32;32 PM $50

12...(0)...04;33;38 AM $60 target

10 max...(-3)...08;42;20 PM

10 max...(-13)...07;04;24 PM

Raise your STOP level ASAP after entry to minimize losses.

This loss could have been limited to a few points or to break even.

+41...(6)...11;44;37 AM $200 maximum vs ($30 draw-down)

+6...(5)...09;17;29 AM maximum $30 vs (Stopped $25)

+20...(2)...07;14;02 PM $100 vs ($10 draw-down)

+1...(5)...04;12;08 PM $10 vs ($25 stopped)

+5...(5)...02;44;25 PM $25 maximum B4 ($25 STOP)

+12...(0)...11;39;45 AM $60 minimum vs ($0 draw-down)

+6...(5)...08;17;09 AM $30 maximum B4 ($32 draw-down)

+19...(9)...07;47;52 AM +$95 vs ($45 draw-down)

+16...(2)...04;37;51 PM +$80 vs ($10 draw-down

+16...(3)...12;11;30 PM +$80 vs ($15 draw-down)

stopped (5)...05;48;40 AM ($25)

+8...(2)...08;46;54 PM $40 max vs ($10)

+26 or +49...(0)...(07;08;40 PM $130 or $245 vs (0 draw-down)

+12...(1)...07;05;21 PM $60 vs ($0)

+25...(15)...04;12;18 PM $125 vs ($15)

+3...(5)...12;14;31 PM $15 vs ($20)

+12...(4)...03;15;53 PM +$60 vs ($20)

missed getting a fill...11;05;38 AM

+35...(0)...10;12;22 AM +$175 vs (0)

|

| Signals on RH chart fire "later" due to slight difference in ticks-per-bar |

02/14/22 Monday night (start of Tuesday's session)

+11...(0)...07;45;27 PM +$55 vs (0)

(left a lot on the table)

+5...(5)...03;50;56 PM... +25 vs $32

+5...(5)...07;37;49 PM...+$18 vs $32

+12...(2)...06;02;40 PM...+$60 vs $17

+21...(5)...01;55;35 PM...$205 vs $32

+5...(1)...08;17;15 AM...-$12 net

Moving your STOP up asap makes a big difference..

+12...(0)...07;18;35 PM

02/06/22 Sunday night

+18...(-4)...08;36;03 PM

+31...(-7)...06;23;01 PM

+34+...09;22;45 AM...max draw-down of $32 for $170+ gain

02/03/22 Thursday night

+10+...08;28;19 PM

02/03/22 Thursday

...Some days you do 10x better than others...

Practice trades - 10 point TARGET with 5 point STOP

+10 and +10...04:18:35 AM

Other "practice trades" this morning

02/02/22 Wednesday

+25...02;46;25 PM on 02-02-22

+40...12;42;45 PM on 02-02-22

+35...12;11;57 PM on 02-02-22

02/01/22 Tuesday

+32...08;07;20 AM on 02-01-22

01/31/22 Monday

+9...04;15;40 PM on 01-31-22

+17...08;44;27 AM on 01-31-22

01/30/22 Sunday night

+19...08;35;09 PM on 01-30-22

01/27/22 Thursday

+35...04;57;55 PM on 01-27-22

+32...both turned...04;01;54 PM on 01-27-22

+33...both turned...03;18;27 PM on 01-27-22

+12...10;13;08 AM on 01-27-22

+12...07;27;32 AM on 01-27-22

01/24/22 Monday

High volume - wide range session

Nice trading day

01/18/22 Tuesday

+6..+6..+6...01;33;58 PM on 01-18-22

01/17/22 Monday

+18...(-0)...11;20;10 AM on 01-17-22

+0...quit...08;48;24 AM on 01-17-22

+13 minimum...(-0)...06;42;09 AM on 01-17-22

01/16/22 Sun night

+0 missed fill...07;25;51 PM on 01-16-22

01/14/22 Friday Some days you do better than others

+10 minimum...(-0)...04;23;11 PM on 01-14-22

+10 minimum...(-3)...03;11;36 PM on 01-14-22

+15...(-0)...02;33;57 PM on 01-14-22

+12...(-3)...11;03;49 AM on 01-14-22

+21..(-1)..01;28;07 AM on 01-14-22

01/13/22 Thursday

+30..-0..07;06;14 PM on 01-13-22

+29..(-3)..06;16;20 AM on 01-13-22

01/12/22 Wednesday

+6...03;49;19 PM on 01-12-22

+9...03;03;58 PM on 01-12-22

+1 then stopped...02;30;59 PM on 01-12-22

01/11/22 Tuesday

+6...03;15;01 PM on 01-11-22

+4 then stopped...01;50;11 PM on 01-11-22

missed 10;11;01 AM on 01-11-22

+2 then stopped...08;38;40 AM on 01-11-22

01/10/22 Monday

+6 06;43;40; AM on 01-10-22

01/07/22 Friday test trades

(0-)(13+) 04;21;12; PM on 01-07-22

(0-)(6+) 04;14;56; PM on 01-07-22

(0-)(12+) 03;18;08; PM on 01-07-22

01/06/22 Thursday test trades

(3-)(17+) 08;18;20; PM on 01-06-22

(2-)(10+) 01;34;13; PM on 01-06-22

(3-)(12+) 04;49;17 AM on 01-06-22

01/05/22 Wednesday test trades

Saw few good opportunities today....Price action and indicator prints seemed out of sync.

01/04/21 Tuesday night test trades

(0-)(6+) 06.31.39 PM on 01-04-22

01/04/22 Tuesday test trades

(0-)(6+) 12.23.34 PM on 01-04-22

(3-)(10+) 11.59.44 AM on 01-04-22

(2-)(11+) 07.40.28 AM on 01-04-22

01/03/22 Monday test trades

(2-)(10+) 04.33.44 PM on 01-03-22

(4-)(10+) 02.15.58 PM on 01-03-22

(0-)(9+) 02.06.34 PM on 01-03-22

(3-)(0+) 08.17.28 AM on 01-03-22

01/02/22 Sunday night - test trades

p (-3)(+6) 08.22.15 PM on 01-02-22

p (S-4)(T+22) 06.42.46 PM on 01-02-22

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...jpg)

%20%20...jpg)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...jpg)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

%20%20...png)

.jpg)

...png)

%20%20...png)

%2020%20pnt...$100.png)