These chart sets represent individual trades for the dates noted and usually include

1) Entry + rationals 2) Results and often 3) What occurred afterward

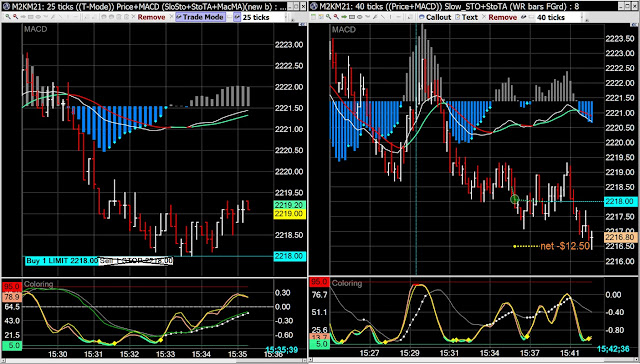

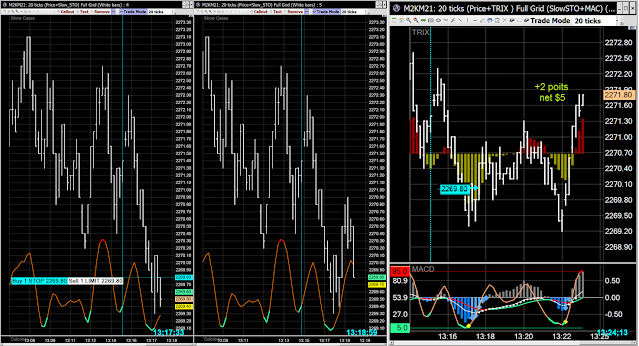

MACD is for TREND...stochastic tells you WHEN

-------------------------------------------------------------------------------------------------------

The markets seem explosively volatile as of late

I'm testing a different entry system...mostly Buy-Stops

The chart examples will be marked as practice or test trades and described as follows:

(+p long entry) (-p short entry) (Stop in points)(Target potential) time & date taken

Test trades since 12/03/21:

A Simple method

An un-scientific guess -- it looks like using a Buy-Stop for entry with brackets (3 point initial stop and a 6 point initial Target) would amount to a

65-70% Win/Loss ratio and yield a positive return...

Add the possibility of being able to raise the protective

Stop and/or the Target level should increase the potential for better gains...

------------------------------------------------------------------------------------------------------

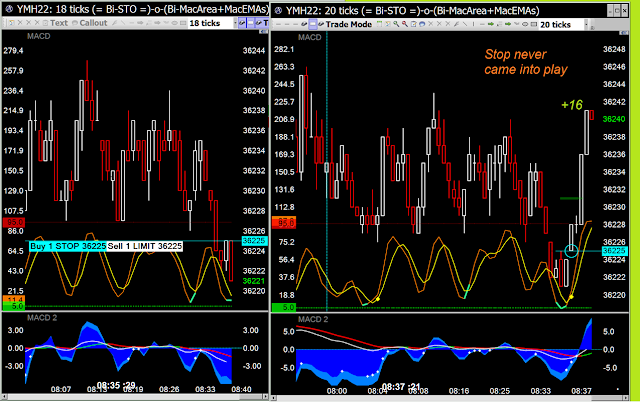

12/31/21 Friday test trades

(S-0)(T+16) 08.35.29 AM on 12-31-21

12/30/21 Thursday test trades

+p (S-0)(T+8) 04.42.27 PM on 12-30-21

+p (S-8)(T+4) 04.31.35 PM on 12-30-21

+p (S-2)(T+14) 03.15.34 PM on 12-30-21

+P (S-1)(T+9) 09.54.58 AM on 12-30-21

12/29/21 Wed night test trades

+p (S-4)(T+12 08.50.00 PM on 12-29-21

+p (S-4)(T+23) 08.05.38 PM on 12-29-21

12/29/21 Wednesday test trades

+p (S-0)(T+7) 01.09.12 PM on 12-29-21

+p (S-0)(T+6) 07.48.31 AM on 12-29-21

+p (S-0)(T+9) 06.30.13 AM on 12-29-21

12/28/21 Tues night

+p (S-2)(T+15) 07.39.24 PM on 12-28-21

12/28/21 Tuesday test trades

+p (S-1)(T+6) 03.49.23 PM on 12-28-21

+p (S-0)(T+10) 03.19.29 PM on 12-28-21

12/27/21 Monday test trades

+p (S-1)(T+7) 01;35;08 on 12-27-21

+p (S-0)(T+13) 12;38;20 on 12-27-21

+p (S-3)(T+18) 08;02;17 on 12-27-21

2/26/21 Sun night test trades

+p (S-13)(T+6) 06;20;51 on 12-26-21

2/23/21 Thursday practice trades

+p (S-0)(T+25) 11;04;07 on 12-23-21

+p (S-4)(T+8) 10;35;29 on 12-23-21

+p (S-1)(T+11) 09;19;33 on 12-23-21

2/22/21 Wed night practice trades

+p (S-0)(T+14) 08;02;28 on 12-22-21

12/22/21 Wednesday practice trades

+p (S-0)(T+7) 04;21;56 on 12-22-21

+p (S-0)(T+13) 12;36;13 on 12-22-21

+p (S-0)(T+7) 07;29;36 on 12-22-21

12/21/21 Tues night practice trade

+p (S-3)(T+11) 08;53;49 on 12-21-21

+p (S-8)(T+19) 06;58;12 on 12-21-21

12/21/21 Tuesday (practice trades)

+p (S-0)(T+12) 01;06;17 on 12-21-21

+p (S-0)(T+35) 02;25;31 on 12-21-21

+p (S-3)(T+15) 10;19;47 on 12-21-21

+p (S-5)(T+29) 02;44;01 on 12-21-21

12/17/21 - Many practice trades were recorded this week:

Friday 12/17/21

Thursday night 12/16/21

Wednesday night 12/15/21

Wednesday 12/15/21

Tuesday 12/14/21

Monday 12/13/21

Sunday night 12/12/21

12/10/21 Friday

Rolled to the March '22 series contracts ... Dec '21 contract expires

next Friday 12/17/21 but is still very active.

12/02/21 Thursday

Practice Trades -- training the hands and mind

I have Gadwin's "print-screen" program installed on my machine.

It is set to capture a .jpeg or .PMG image of the window that's under the cursor. It will automatically

name all captured images and save them by date and time to a designated file of my choosing.

I use the following method to "train" my fingers and test my reaction time while also determining

what bracket order levels will work best in the current market pace conditions.

Make sure ON-CHART-TRADING is OFF before trying this...

12/01/21 Wednesday

11/29/21 Monday

Nov 26 Friday

Nov 25 Thursday

Nov 24 Wednesday

Nov 23 Tuesday night (Wednesday's session)

Nov 24 Tuesday (no trades taken)

Nov 23 Monday night (Tuesday's session)

Nov 22 Monday

Nov 21 Sunday night (Monday's session)

Sometimes the indicators are

spot on

Nov 17 Wednesday

Nov 15 Monday

Nov 10 Wednesday

Nov 9 Tuesday

Nov 8 Monday

Nov 4 Thursday

an occasional short trade

Nov 03 Wednesday

Nov 02 Tuesday night

Nov 02 Tuesday

Oct 29 Friday

Oct 28 Thursday night

Oct 28 Thursday

Oct 27 Wednesday night

Oct 27 Wednesday

------------

Oct 26 Tuesday night

Oct 26 Tuesday

Oct 25 Monday night

Oct 25 Monday

Oct 24 Sunday night

|

| - - - - - - - - - - - - - - - - - - - - |

|

| - - - - - - - - - - - - - - - - - - - - |

Oct 22 Friday

Oct 21 Thursday night

Oct 21 Thursday

Oct 20 Wednesday

|

| ------------------------ gain----------------------------- |

|

| --------------------------------------------------------- |

|

| Oversold... Overbought... |

|

| ------------------------ gain----------------------------- |

Oct 18 Monday

|

| Gain |

Oct 14 Thursday

Oct 11 Monday

Oct 10 Sunday night

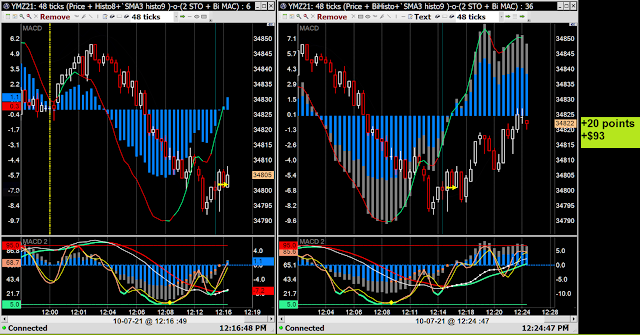

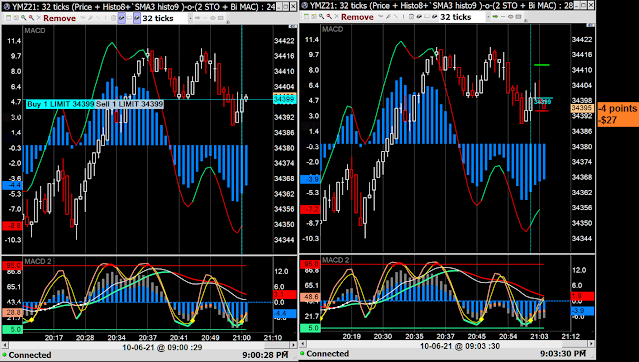

Oct 07 Thursday

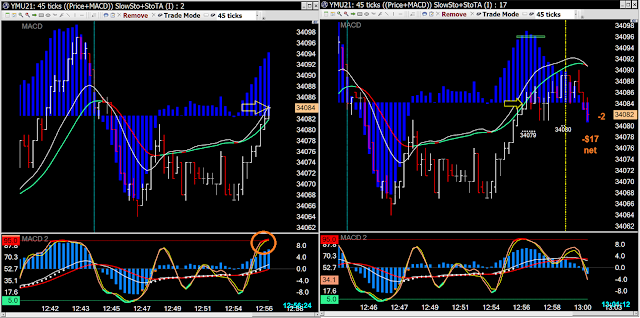

Oct 06 Wed night

Oct 05 Tuesday

Oct 04 Monday

Sept 29 Wednesday

Sept 27 Monday

Sept 23 Thursday night

Sept 16 Thursday

...tough day...2 winners out of 6...

Sept 15 Wednesday night

Sept 15 Wednesday

Sept 14 Tuesday night

Sept 14 Tuesday

Sept 13 Monday

Sept 10 Friday

Sept 09 Thursday night

Sept 09 Thursday

Sept 09 ThursdaySept 08 Wednesday

Sept 07 Tuesday

Sept 06 Monday night

Sept 06 Monday - Labor Day 1 PM EST close

|

| ...♫ goes to show you never can tell ♫... |

Sept 05 Sunday night

Sept 03 Friday

Sept 02 Thursday night

Sept 02 Thursday

Sept 01 Wednesday night

Tough to recover from - stop for tonight

...but I didn't stop

Aug 31 Tuesday

Aug 30 Monday night

Aug 30 Monday

Aug 29 Sunday night

Aug 27 Friday

Sometimes you string winners together

Aug 26 Thursday night

Aug 26 Thursday

Aug 25 Wednesday

Aug 24 Tuesday

Aug 23 Monday

Aug 22 Sunday night

Aug 20 Friday

Aug 18 Wednesday

Aug 17 Tuesday night

|

| What happened after the trade above was completed |

Aug 17 Tuesday

|

| Sometimes you catch a runner ! |

Aug 16 Monday

Aug 13 Friday

|

| +$213 From Demo platform on backup machine |

Aug 10 Tuesday night

|

| 7:30 PM net +$43 |

Aug 3 Tuesday

|

| 1:10 PM net +$53 |

Aug 2 Monday

|

| 12 PM +$83 |

|

| 8:07 AM -$32 |

|

| 6:08 AM -$32 |

Aug 1 Sunday night

|

| 7:45 PM net -$8 |

|

| 7:00 PM net -$7.50 |

July 30 Friday

|

2:00 net -$32

|

|

| 2:15 +$18 |

|

| 6:10 AM net $53 |

July 29 Thursday

|

| 1:13 net +$8 |

|

| 10:00 net +$53 |

|

| 9:50 net +$53 |

July 28 Wednesday night |

| 21:52 net -$22 |

July 28 Wednesday

|

| 4:10 net $53 |

|

4:00 net $53

|

|

| 3:30 net -$32 |

July 27 Tuesday night

|

| 8:35 +$23 |

7:25 -$32

7:25 -$32

July 27 Tuesday

|

| 4:00 net $53 ( luck sometimes pays) |

|

| 2:00 net $53...buy stop again |

|

| 1:30 net $53 ...Buy Stop for the entry |

July 26 Monday

|

| Good signals but they "failed" |

|

| Didn't realize I was trading the micro, not the emini |

|

| missed fill |

|

| Sometimes the bear eats you, sometimes you eat the bear |

July 23 Friday

Net gain of $83 for the week on 14 trades in the YM E-minis and Micros.

Seems like a lotta time to spend for very little return...

BUT there's always next week...

|

| Thru 4:35 net -$23 |

|

Playing the TLB Retest but was not filled

|

|

Thru 12:22 net -$11

|

|

Thru 11:55 net -$64

|

July 20 Wednesday

July 20 Tuesday night

|

| Long wait for the BIG payoff...😊 |

The micro YM is tough to take money from.

July 20 Tuesday

2 stop outs and 1 winner for a whole $3...

The micro YM is tough to take money from.

July 19 Monday

DOW 30 tanking

To buy or not to buy - do you feel lucky?Potential for a 2B bottom as an excuse to make a entry?  |

| Longer term P/A leading up to the $32 loss shown above |

July 16 Friday

July 15 Thursday night

July 15 Thursday

July 14 Wednesday night

July 14 Wednesday

|

| ♫...goes to show you never can tell...♫ |

July 13 Tuesday

July 12 Monday

|

| Another $50 was left on the table |

July 9 Friday

July 8 Thursday

July 6 Tuesday night for Wed's session

|

| Reversal doji's while overbought |

July 6 Tuesday

July 5 Monday night

"I don't always sell short, but when I do..."

July 2 Friday

Not the greatest day's results but not a loss

..................................

July 1 Thursday

.......................................

...................................

June 30 Wednesday

Trying to make something happen ...

...and what happened afterward...

Tuesday night

June 29 Tuesday

Monday night for Tuesday's session

June 28 Monday

Got out before loss...

...nope, still not with it...

June 25 Friday

Brackets - initial Target 12 points, initial Stop 5 points...

A loss of $2 vs a loss of $32 by neglecting to manage your trade.

|

| Trade management - stay on top of where your Stop level is |

June 24 Thursday

|

| A successful trade (above) and what happened after (below) |

June 23 Wednesday

|

| The chart above is a continuation of the chart below |

June 22 Tuesday session

Leaving some on the table is to be expected, but it's even more difficult to leave trades un-taken... "In all the excitement..."

June 21 Monday session

no trades

June 20 Sunday night

3 for 4 is a good start to the week !

|

| Again - not the best signals but a gain is a gain... |

|

| Not the best signals perhaps but it worked |

June 18 Friday

June 17 Thursday

Went back to practicing...

'Shoulda' been just a practice trade...

Missed a big move...it happens relatively often

June 16 Wednesday

Weak entry rational but raising the stop reduced the loss by $10

June 15 Tuesday

June 14 Monday

Two trades taken today for a net -$19.

The markets can frustrate...if you let them...

and once again I missed a good move June 11 Friday

June 10 Thursday

June 9 Wednesday

June 8 Tuesday

Coulda-Shoulda? Hard to tell sometimes ...

Price ran up in-spite of my rationalizations...

June 7 Monday

What happened after taking the bracket gain:

1st trade attempt resulted in a break-even ... Raising your

initial stop-loss is almost as important as taking gains

June 4 Friday

June 3, Start of Friday's session

June 3, Wednesday

The E-minis offer better opportunities

for short term scalping than the MICROs

(in-and-out within minutes)

|

| Including the above charts for perspective on the previous trade... |

|

Anticipating a 1-2 Punch pattern and playing the SLINGSHOT

with the MACD EMAs rising

|

June 2, Tuesday

June 1, Start Wed session (Tues night)

...and this seems to happens every time:

June 1, Tuesday

May 31 Monday, Memorial Day

May 28 Friday

May 27 Thursday night (Friday's session begins)

May 27 Thursday

Are the MICROs it worth the effort for such tiny gains?

Even if you trade multiple contracts you still get nailed with a $5 commission

per round turn ON EACH CONTRACT...

But yes it can be worth the effort ...May 26 Wednesday night

May 26 Wednesday

They are not always great ones

Slingshots are happening this morning

May 26 Wednesday's session (Tuesday night)

May 25 Tuesday

May 24 Monday

Did not take :

May 21 Friday

May 19 Wednesday

Mid day rising wedge in a down trend:

Took a little bit out this morning

May 18 Tuesday

May 16 Sunday night

May 14 Friday

May 13 Thursday

May 12 Wednesday

The guessing game...risk $10 for possible $10 gain...sometimes you eat the bear

May 11 Tuesday

May 10 Monday

These next 3 chart sets are showing the same run

May 5 Thursday night...netting $19

Same trade - - afterwards

May 5 Wednesday

May 3 Monday

2B on multiple time frames - sometimes you catch a runner

May 2 Sunday night

A 10 point gain after commission is only $15 net...Micros are tough to trade for the short term.

April 30 Friday

April 29 Thursday

April 27 Tuesday

April 25 Sunday night

April 23 Friday

April 18 Sunday night

April 15 Thursday

April 14 Wednesday

April 12, Monday

Back to back winning trades:

------------------------------

April 11, Sunday night

April 9, Friday

Taking only $5 is better than letting your

STOP determine the outcome...

Even if you can raise it to price B/E, commission makes it a loss...

April 8, 2021 Thursday night

April 7, 2021 Wednesday

"Blue-Line" trade entry signals

April 6 2021 Tuesday

-----------------------------------

April 5, 2021 Monday night

April 5 2021 Monday

April 4, 2021 Sunday night

April 1, 2021 Thursday

Sometimes you need to take a profit, even if it's less than you'd like...

Sometimes you don't catch a fill...

March 31, 2021 Wednesday

March 30, 2021 Tuesday night (the start of Wednesday's session)

This is the trade - the above two charts show what happened afterward...

March 29, 2021 Monday

3 trades netting $22 for Sunday thru Monday's session

March 28,2021 Sunday night

March 26, 2021 Friday

RTY Micro trade charts for deciding entries

March 25, 2012 Thursday

March 23, 2012 Wednesday

March 23, 2021 Tuesday

A net $4 loss -- three trades before the major markets opened today

March 19, 2021...Friday

Mar 18 Thursday night

March 18 Thursday

March 17 Wednesday

...Reminder - pay attention to visual clues for better ENTRIES...

March 16 Tuesday

March 15 Monday

Mar 14 Sunday night

Mar 12 Friday - net $100 on 4 trades

Mar 11 Thurs night

March 11 Thursday

March 8 Monday

March 3 Wednesday

March 2 Tuesday night

March 2 Tuesday

Feb 28 Sunday night

Feb 26 Friday

New template with stochastic in the price pane

Feb 25 Thursday night

Feb 24 Wednesday night

Feb 24 Wednesday

Feb 23 Tuesday night

Feb 23 Tuesday

Feb 21 Sunday night

Feb 19 Friday

Feb 17 Wednesday

Feb 16 Tuesday night

Feb16 Tuesday

Feb 15 Monday night

Feb 15 Monday

Feb 14 Sunday night

Feb 12 Friday

Feb 11 Thursday

Feb 10 Wednesday

Feb 9 Tuesday

|

| Looking for a pull back fill did not get one |

Feb 8 Monday

Feb 5 Friday

Feb 4 Thursday

|

| Thurs night |

Feb 3 Wednesday

Jan 28 Thursday

Jan 27, 2021 Wednesday

Jan 25 Monday

Jan 20 Wednesday

Jan 17 Sunday night

Jan 13 Wednesday

Jan 7 Thursday

Jan 6 2021 Wednesday

Jan 4 2021 Monday