JUNE 2014 Trade Statistics and activity

Good Winning percentage and excellent Tick Win/Loss ratio...Average Point Gain number is much improved over May's numbers.

I took fewer trades this month - concentrating on taking the 'better' set ups.

Daily Trade Activity

June EOM Summary Charts

***********************

June Daily trade Charts

Good Winning percentage and excellent Tick Win/Loss ratio...Average Point Gain number is much improved over May's numbers.

I took fewer trades this month - concentrating on taking the 'better' set ups.

Daily Trade Activity

June EOM Summary Charts

***********************

June Daily trade Charts

The dates and days headers are followed by the number of winning/losing trades, then

the point gain/loss per contract and the dollar amount for the day.

the point gain/loss per contract and the dollar amount for the day.

(The calculation includes commissions and assumes only 1 contract was taken per trade)

Please understand that ALL my B/E or small stop-outs may not be included here.

I prefer to have my winning trades available for review unless there's something important to be gained by looking at the losses

(like pointing out poor trade decisions so I can try not to repeat them)

__________________________________________________

Monday 6/30/2014...1/0...+9 or $38

I did not see any good signals in today's pre-market but shortly after the majors

opened this TEST trade showed some promise for the day...signals on two time frames...

But the look didn't last long after a series of sparse signals and signal failures.

In the afternoon I tried trailing down a stop based on the MACDh DIV and O/S STO...

(lucky it was not filled)

This trade was soooo-slooow...but it gave me time to think about

how to use the WMA for more than just a reference.

Friday 6/27/2014...no trades

Thursday 6/26/2014...1/1...+17 or +$158

Still rockin in the pre-market

Wednesday 6/25/2014...4/2...+39 or +$380

Great results on the day...after big drops yesterday today's ranges were tiny.

Started off using a tighter stop on the brackets today for the RUT...

Kept the brackets unchanged for the YM

Changed RLM sell bracket stop back to -4 ...some TEST TRADES showed me that today was a 'runner 'day....

....and I caught one of them running...

A 2B failure...

I used histo divergence signals from the 90 tick (not shown) and the 60 tick as my rational to play...

I placed a limit order at the trend line break looking for a re-test...it did and I got my fill.

Tuesday 6/24/2014...2/0...+19 or +$178

No pre-market trades today but good starting off...well out of the RUT.

Noticed the PPP after the trade ended.

Today's RUT session so far...

The YM + ES for the session so far...

Heading into lunch time with a H&S pattern

The pros returned from lunch and were not eager to end the trend...

Missed by a tick...

Monday 6/23/2014...1/0...+10 or +$100

Early morning...missed this trade

Friday 06/20/2014...no trades

I did take some snapshots...

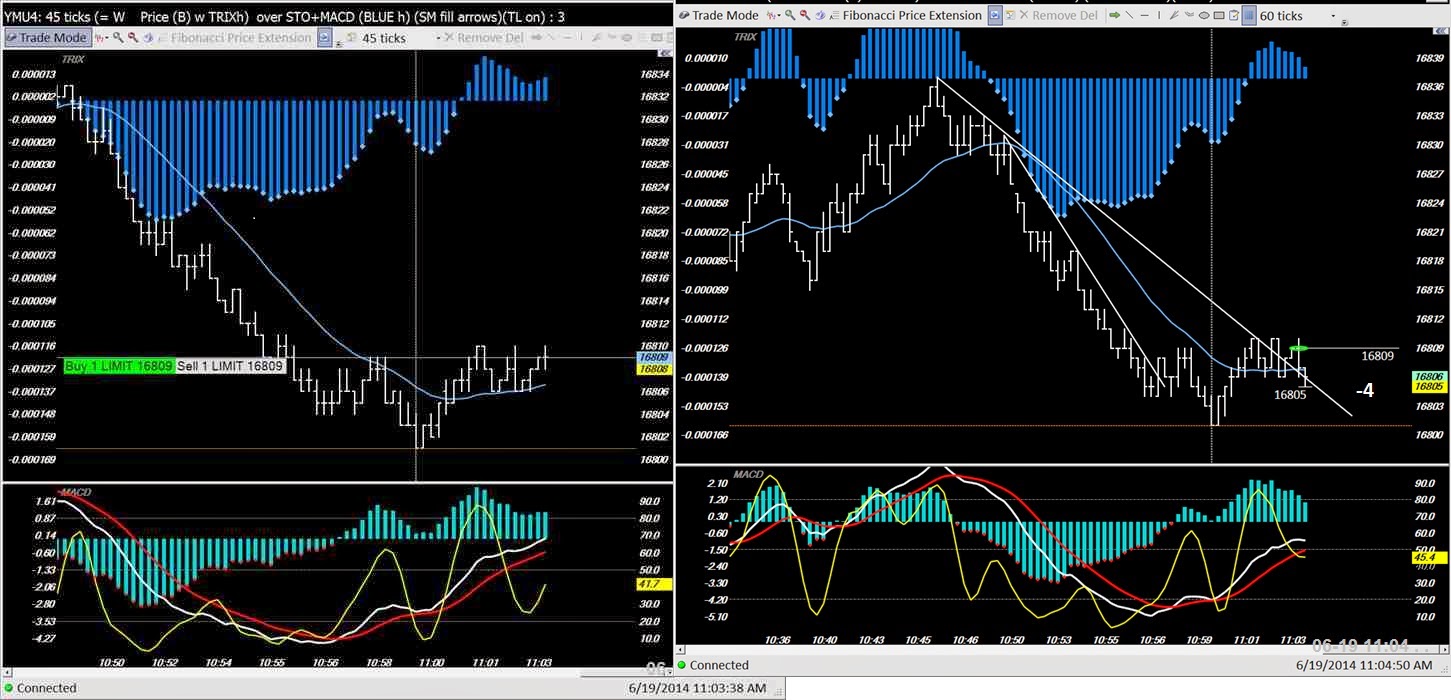

Thursday 6/19/2014...3/1...+16 or +$55

Well defined patterns before the majors opened...

Major markets about to close...good signals = good results

Wednesday 6/18/2014...2/1...+14 or +$51

Nutso reaction to FED minutes

Tuesday 6/17/2014...0/1...-4 or -$26

Stopped out on one of the few good signal trades I saw today...

Monday 6/16/2014...No trades

TEST TRADES were not telling me much today.

There were a lot of stop runs of more than 4 ticks after the 'practice' entry and signals were unconvincing.

Friday 6/13/2014...1 W 2 L...+13 or +$116

Before the bell "pace" is usually slower and lately it seems the runs go a bit further than during regular market hours...+21

Total exposure time was around 20 minutes for $200...2 to 3 x my normal exposure time and 2 x my normal return

Gave some back...-4

Gave some more back...-4

TEST Trade set A...

Mediocre signals - histograms rising and O/S STO

This set illustrates why I should wait for good signals.

TEST Trade set B compared to TEST Trade set A above - Just 12 minutes later...

Good signals - Divergent histograms and STO

WAITING FOR GOOD SIGNALS = GOOD RESULTS

Thursday 6/12/2014...3 W 3 L...+11 or +$73

Signals got sparse and too much range as the day developed...downwards.

TEST trades started failing left and right - tho the day may change I'm done for now...

Trades...

Signals began to look a little clearer...

But the nervousness remained...

Wednesday 6/11/2014...TEST trades only

Was a bit under the weather today, slow to react...but there were plenty of opportunities.

Noticed the YM lagging in the morning...

Pre MMO...TLB + Re-Test

TLB with Re-Test

Divergence + Sling

2B

TLB with Re-Test

Tuesday 6/10/2014...2/0...+16 or +$148

Good start before the majors opened

TESTS

Took this one...

and the coulda-shoulda after taking +6 gain shown on the above trade...

I'm not complaining - a win is a win...

Still, I can't help laughing at myself for documenting so many good TEST trades

only to finish the day with a +6 trade that ran after I closed it out...

Monday 6/9/2014...1 W and 2 L...+6 or +$15

Early morning TEST TRADE

Pre-opening TEST TRADE - fail

10:45

Lunch time - good signals failed

But meanwhile the RUT was firing off good signals and running

TLB fails the Re-Test

Another money maker...missed...my timing is off, time for a break.

Friday 6/6/2014...TEST TRADES ONLY

After yesterday's nearly continual - great trade signals with follow-thru I sort of expected that today would be different.

(of course every day is different, except when they are not)

Finally a great set of signals and follow-thru...

Thursday 6/5/2014...2/0...+26 or +$248

Could have had another tremendous day as signals were firing & working all day...but up is up...

Included are some of the 'missed' trades...

And just to start tracking short plays for the days that longs are not working...

Wednesday 6/4/2014...2/1...+11 or +$92

Tuesday 6/3/2014...3/2...+15 or +$120

Monday 6/02/2014...no trades

Failed test trades

2 in a row that got away

Relative to the ones that got away

Still with the test trades

Relative to the test above

RUT not participating in the afternoon rally

Please understand that ALL my B/E or small stop-outs may not be included here.

I prefer to have my winning trades available for review unless there's something important to be gained by looking at the losses

(like pointing out poor trade decisions so I can try not to repeat them)

__________________________________________________

Monday 6/30/2014...1/0...+9 or $38

I did not see any good signals in today's pre-market but shortly after the majors

opened this TEST trade showed some promise for the day...signals on two time frames...

But the look didn't last long after a series of sparse signals and signal failures.

In the afternoon I tried trailing down a stop based on the MACDh DIV and O/S STO...

(lucky it was not filled)

This trade was soooo-slooow...but it gave me time to think about

how to use the WMA for more than just a reference.

Friday 6/27/2014...no trades

Thursday 6/26/2014...1/1...+17 or +$158

Still rockin in the pre-market

Signals were pretty good but was stopped out in a minute

Wednesday 6/25/2014...4/2...+39 or +$380

Great results on the day...after big drops yesterday today's ranges were tiny.

Started off using a tighter stop on the brackets today for the RUT...

Kept the brackets unchanged for the YM

....and I caught one of them running...

A 2B failure...

I used histo divergence signals from the 90 tick (not shown) and the 60 tick as my rational to play...

I placed a limit order at the trend line break looking for a re-test...it did and I got my fill.

Tuesday 6/24/2014...2/0...+19 or +$178

No pre-market trades today but good starting off...well out of the RUT.

Noticed the PPP after the trade ended.

Today's RUT session so far...

The YM + ES for the session so far...

Heading into lunch time with a H&S pattern

The pros returned from lunch and were not eager to end the trend...

Missed by a tick...

Monday 6/23/2014...1/0...+10 or +$100

Early morning...missed this trade

Nice 2B Dragon after divergences at its rear legs...+10

Signals were firing and following thru but I was not paying attention today.

Here's the YM and RLM both signaling at lunch time.

Friday 06/20/2014...no trades

I did take some snapshots...

Thursday 6/19/2014...3/1...+16 or +$55

Well defined patterns before the majors opened...

Major markets about to close...good signals = good results

Wednesday 6/18/2014...2/1...+14 or +$51

Nutso reaction to FED minutes

Tuesday 6/17/2014...0/1...-4 or -$26

Stopped out on one of the few good signal trades I saw today...

Monday 6/16/2014...No trades

TEST TRADES were not telling me much today.

There were a lot of stop runs of more than 4 ticks after the 'practice' entry and signals were unconvincing.

Friday 6/13/2014...1 W 2 L...+13 or +$116

Before the bell "pace" is usually slower and lately it seems the runs go a bit further than during regular market hours...+21

Total exposure time was around 20 minutes for $200...2 to 3 x my normal exposure time and 2 x my normal return

Gave some back...-4

Gave some more back...-4

TEST Trade set A...

Mediocre signals - histograms rising and O/S STO

This set illustrates why I should wait for good signals.

TEST Trade set B compared to TEST Trade set A above - Just 12 minutes later...

Good signals - Divergent histograms and STO

WAITING FOR GOOD SIGNALS = GOOD RESULTS

Thursday 6/12/2014...3 W 3 L...+11 or +$73

Signals got sparse and too much range as the day developed...downwards.

TEST trades started failing left and right - tho the day may change I'm done for now...

Trades...

Signals began to look a little clearer...

But the nervousness remained...

Wednesday 6/11/2014...TEST trades only

Was a bit under the weather today, slow to react...but there were plenty of opportunities.

Noticed the YM lagging in the morning...

Pre MMO...TLB + Re-Test

Divergence + Sling

2B

TLB with Re-Test

Tuesday 6/10/2014...2/0...+16 or +$148

Good start before the majors opened

TESTS

and the coulda-shoulda after taking +6 gain shown on the above trade...

I'm not complaining - a win is a win...

Still, I can't help laughing at myself for documenting so many good TEST trades

only to finish the day with a +6 trade that ran after I closed it out...

Monday 6/9/2014...1 W and 2 L...+6 or +$15

Early morning TEST TRADE

Pre-opening TEST TRADE - fail

10:45

Lunch time - good signals failed

TLB fails the Re-Test

Another money maker...missed...my timing is off, time for a break.

Friday 6/6/2014...TEST TRADES ONLY

After yesterday's nearly continual - great trade signals with follow-thru I sort of expected that today would be different.

(of course every day is different, except when they are not)

Finally a great set of signals and follow-thru...

Thursday 6/5/2014...2/0...+26 or +$248

Could have had another tremendous day as signals were firing & working all day...but up is up...

Included are some of the 'missed' trades...

And just to start tracking short plays for the days that longs are not working...

Wednesday 6/4/2014...2/1...+11 or +$92

Tuesday 6/3/2014...3/2...+15 or +$120

Monday 6/02/2014...no trades

Failed test trades

2 in a row that got away

Relative to the ones that got away

Still with the test trades

Relative to the test above

RUT not participating in the afternoon rally