January 2014 trade summary, statistics and comments

My AVE Win % was good this month but my Ave. Point Gain dropped while Ave. Point Loss rose - not a good combination.

This is reflected in the 1.9 Tick Win/Loss ratio. Still - the bottom line was positive although not stellar...

Didn't take very many trades again this month.

The Monthly and cummulative numbers are still good but of course these will change slowly

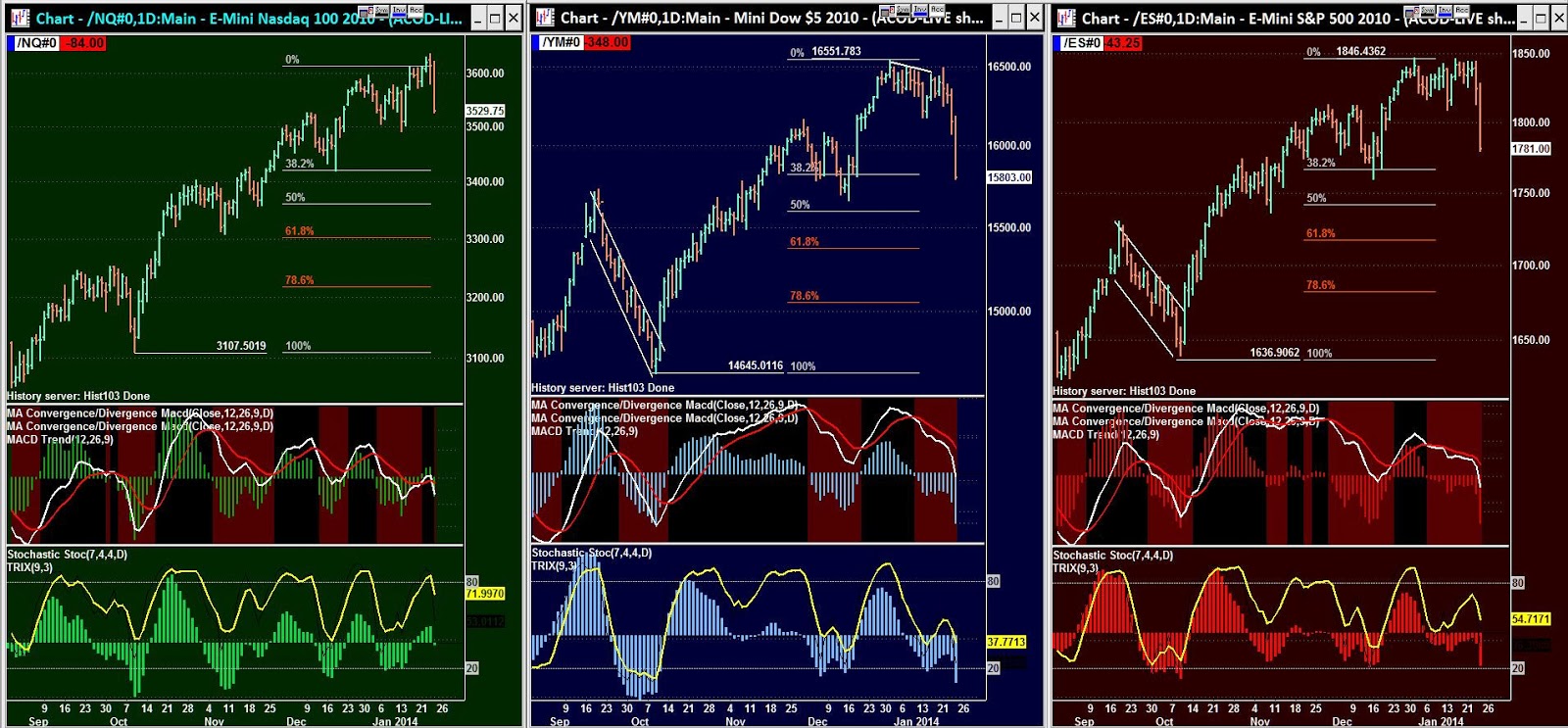

January EOM Summary Charts

**************************

01/31/2014 Friday...no trades today

Kinda mixed up markets today...some examples of on-then-off opportunities:

This is reflected in the 1.9 Tick Win/Loss ratio. Still - the bottom line was positive although not stellar...

Didn't take very many trades again this month.

The Monthly and cummulative numbers are still good but of course these will change slowly

Daily activity on which all the above statistics are based:

January EOM Summary Charts

**************************

January Daily trade Results

The dates and days headers are followed by the number of winning/losing trades, then the point gain/loss per contract and the dollar amount for the day

(The calculation includes commissions and assumes only 1 contract was taken per trade)

__________________________________________________

__________________________________________________

01/31/2014 Friday...no trades today

Kinda mixed up markets today...some examples of on-then-off opportunities:

01/30/2014 Thursday...1/2...-1 or -$42

Today is an example of how NOT to trade...Started out with a winning trade but lost my concentration

after the second consecutive stop-out...Charts of missed opportunities are included below those that were taken.

Missed opportunities - its tough to be perfect every day...

I didn't get a fill here even though my limit order price was touched. Somebody got a few contracts at the MOF.

Just didn't see this one 'til it passed me by...

My lack of concentration prevented me from participating on any of these great opportunities...but there's always another trading day approaching.

after the second consecutive stop-out...Charts of missed opportunities are included below those that were taken.

Missed opportunities - its tough to be perfect every day...

I didn't get a fill here even though my limit order price was touched. Somebody got a few contracts at the MOF.

Just didn't see this one 'til it passed me by...

01/29/2014 Wednesday...1/3...-1 or -$16

Another major down day with outside bars on the dailies...

01/28/2014 Tuesday...2/2...+8 or $21

01/27/2014 Monday...0/3...-15 or $93

Divergence signals were on-then-off...markets were down-up-down

Big moves - just trended down all day...

Thursday----------------------------

Today saw a big down move in the Futs...Took 3 trades and hesitated/missed two good opportunities.

Missed these two good opportunities:

Wednesday----------------------------

Tuesday----------------------------

01/21/2014...no tradesSlightly more active markets with wider ranges following the 3 day weekend.

I saw few good trade opportunities on the faster charts even though the all day charts showed that the YM and ES

both had nice divergent reversals at midday.

Friday----------------------------

Nice trading day. Started out taking quick scalps then caught a runner near the EOD.

Here's a look at the entire week's charts - (90 minute bars Sun-Fri)

Thursday----------------------------

Narrow range choppy markets today - few signals developed.

Failed 2B pattern but no entry was involved

Wednesday----------------------------

Another fairly strong up day...

Lack of focus caused me to miss some good opportunities.

Tuesday----------------------------

Markets recovered a good part of the down move that printed yesterday.

Monday----------------------------

The ADV/DEC/DJI says it all...

Friday----------------------------

01/10/2014 ... no trades today ...Markets dropped then recovered ending the day flat...the ADV/DEC was positive all day...daily DOW flagging...

Thursday----------------------------

The down draft in the morning was strong - signals failed to produce tradable blips...

So I waited 'til after lunch and cherry-picked a few little scalps...

Today's action in the FUTs - - (RLM+YM) and (NQ+ES)...

Wednesday----------------------------

Weird day - started off normal in the pre-market with signals firing...booked a win as the markets started increasing pace...

It was dead at lunch time then got very active for the rest of the day...3:30 reversal zone trade made my day.

Pre-market 'test'...

Trades...

After the B/E trade above I finally recognized that I was going nowhere fast...I took a break while the markets churned for much of the afternoon...

Then a perfect set of signals fired at the 3:30 reversal zone while the markets were still very active...

Tuesday----------------------------

01/07/2014 ... 3/3 ... +11 or +$69

Caught a nice one early morning pre-market...then traded back and forth during the day...

Monday----------------------------Caught a nice one early morning pre-market...then traded back and forth during the day...

01/06/2014 ... 2/1 ... +20 or +$112

Signals were working well considering that it was generally a down day...

ES+YM and NQ+RLM

Friday----------------------------Signals were working well considering that it was generally a down day...

ES+YM and NQ+RLM

01/02/2014...1/0...+10 or +$44

Down trending day...even so, signals were firing through-out much of the day...I just didn't trade them...

Took this one sans-signals before the majors opened...

Down trending day...even so, signals were firing through-out much of the day...I just didn't trade them...

Took this one sans-signals before the majors opened...

+-5+-$31.jpg)

+-5+-$31.jpg)

+-5+-$31.jpg)

++6++$24++++++++++.jpg)

+-4+-$26+++++++++++.jpg)

++6++$24+++.jpg)

++-2+-$16++.jpg)

++5++$19+++.jpg)

+Ad-DC-DJI++.png)

+++4++$34+++++.png)

+++5++$44+++++.png)

+++3++$24+++++.png)

+++5++$44+++++.png)

DIV.png)

++8++$34++++.png)

+-2+-$16++++.png)

++-4+-$26+.png)

+-4+-$26++.png)

++BE+-$6.png)

+++13++$156.png)

++10++$94+++.png)

+cancel+++.png)

++14++$64+++.png)

+-4+-$46+++.png)

+-2+-$16++.png)

++11++$49++.png)

+-4+-$26++.png)