December 2013 trade summary, statistics and comments

Average Win% was exceptional this month...The numbers reflect the relatively low number of round turn trades taken (about 1/2 of my norm). The Ave. Point Gain vs Ave Point Loss numbers are acceptable and are reflected in a good Tick Win/Loss ratio. The bottom line dollar amount was not my highest, yet still very respectable - due mainly to taking the vast majority of trades in the RLM vs the YM or NQ.

Below is copied from my Daily Win/Loss worksheet used to record my trade activity for the month...Note that cell G1 is a cummulative Ave. Win% that excludes the Break Even trades... row 5 is a cummulative running summary of my trade statistics beginning in June 2013 through the present.

The next is copied from my Monthly Statistics workbook and covers June through December 2013. An extensive description of all these spreadsheets, including the formulas for creating them can be found on my Sharpshorts Day Trading blog - Record Keeping and Statistics page.

Tuesday---------------------------

12/31/2013... 1/0 ... +5 or +$44

Another light activity session capping up the year at or near all time highs.

Trading signals were sparse and the mid-day hours were extremely slow.

Monday----------------------------

12/30/2013... 2/2 ... +14 or +$71

Morning started out well but trading conditions deteriorated

as the day dragged on - narrow ranges and no signals to speak of.

12/27/2013... 1/2 - (1 BE) ... +6 or +$12

My timing was a bit off today...plus the markets traded in very narrow ranges.

Activity slowed appreciably in the afternoon...YM+ES and RLM+NQ

Had I stayed at my station after the previous trade, perhaps I would have taken one or all of the trades that followed...

Thursday----------------------------

12/26/2013 ...1/0 ... +21 or +$99

Although there were record gains again today participation was light...(exception - the RUT was down).

Tick/bar sizes required to fill the entire major market hours were very small relative to last week...

Here's the YM with the ES (720 ticks/bar today) and RLM+NQ vs the ES (5500 ticks/bar last week).

Tuesday ----------------------------

12/24/2013 ... 1/0 ... +14 or +$134

Holiday shortened session with the markets still making new highs.

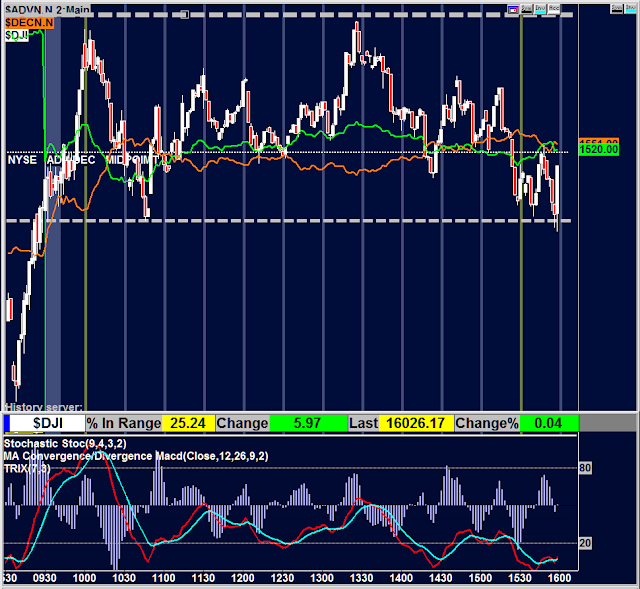

ADV/DEC/DJIA with EOD

Monday ----------------------------

12/23/2013 ... 3/0 ... +18 or +$132

Noticeable slower pace today as reflected in the tick counts of the ES+YM and the RLM+NQ.

Friday ----------------------------

12/20/2013 ... 3/1 ... +16 or $56

Using minute based charts today because it seemed too difficult to find the right intervals on my 'normal' tick based charts...

Worked out well...EOD ADV/DEC/DJI with one month dailies.

Thursday ----------------------------

12/19/2013 ... 0/2 ... -4 or -$32

Took 2 and was stopped on both...Market action this morning was almost as wild as yesterday afternoon...

Today's & yesterday's P/A were similar...interesting differences: Wild morn vs wild afternoon...

Notice the 2500 ticks-per-bar today and the 5500 ticks-per-bar yesterday.

Today:

Yesterday:

Wednesday ----------------------------

12/18/2013 ... 1/1 ... -2 or -$22

Took my stop right at the bottom and stayed away for the rest of the day...

and what a day it turned out to be! ADV/DEC/DJIA and the EOD charts

WHO LET THE DOGS OUT ?

12/17/2013 ... no trades

Was struggling to get the right tick/bar settings until I realized I hadn't rolled to the

futures front month yet...below are a few looks at what was available after I changed my symbols and charts.

(ADV/DEC) and (EOD)

Signals were probably firing off all day!

Monday ----------------------------

12/16/2013 ... 2/0 ... +28 or +$128

Wild overnight session followed by more upside as the majors opened.

Wide range bars even when viewing low tick/bar charts but still won a couple...

Today's ADV/DEC and the EOD charts.

Friday ----------------------------

12/13/2013 ... 1/0 ... +11 or +$49

One and done...was having a bit of difficulty adjusting to the level of activity (or lack there-of)...ADV/DEC and EOD charts.

Took this trade after noticing the NQ lagging the other markets.

Thursday ----------------------------

12/12/2013 ... 2/0 ... +12 or +$48

Another strong down day in the markets, bears may be having their way...EOD

Wednesday ----------------------------

12/11/2013 ... 2/0 ... +14 or +$128

Major sell off today (EOD charts) - perhaps the market didn't like the budget deal.

ADV/DEC was decidedly negative all day

Tuesday ----------------------------

12/10/2013 ... 0/1 ... -2 or -$26

Was a slow grind for me today. Had difficulty paying attention, unable

to focus on the price action...

Monday ----------------------------

Friday ----------------------------

12/06/2013 ... 1/2 ... -6 or -$88

Was getting used to nothing but positive trade days...

A lot of action today, markets ending up...

I didn't see many good signals (even with my new layout having 4 sets of trade charts)

More like a B/E than a gainer...

Two stop outs in a row...

Thursday ----------------------------

12/05/2013 ... 1/0 ... +7 or +$70

Took 1, missed a few trades - re-doing my layout again to show all four markets I trade.

Took this one:

Noticed the YM and NQ were also signaling when the trade above was taken...

Signals firing simultaneously across markets is fairly common.

Thus I spent much of the day re-arranging my layout in an attempt

to enable multi-market trading down the road...

Missed these :

Daily charts from the 'new' layout...

Wednesday ----------------------------

12/04/2013 ... 2/1 ... +28 or +$177

Morning trades, didn't see much in the way of signals in the afternoon.

Tuesday -----------------------------------

12/03/2013 ... 3/2 ...+23 or +$155

The 3:30 reversal zone came in almost to the second and made my day.

Was flat/slightly down for the day up to this point...

Monday -----------------------------------

12/02/2013 ... 2/3 ... +12 or +$90

Signals firing somewhat erratically in the afternoon coinciding with a down turn in the markets.

I can never tell when they're gonna run...

++5++$44++.png)

++14++$64+.png)

++5++$44+.png)

+-2+-$16++.png)

+-3+-$21++.png)

.png)

+the+right+stuff.png)

.png)

.png)

++21++$99++.png)

++14++$134.png)

++10++$94+.png)

++2++$14+.png)

++6++$24+.png)

+-2+-$16.png)

+-2+-$16.png)

+not+filled+-+cancelled+++.png)

++2++$4+++.png)

+-4+-$26+++.png)

++18++$84.png)

++3++$24.jpg)

++11++$104.jpg)