__________________________________________________

SEPT 2014 Trade Statistics and activity

Took quite a few more trades than last month...Ave. Win % was down but my bottom line was reasonable

because trading the RUT and ES kept the Tick Win/Loss ratio up...

Ave. Win % w/o BE trades was still good but below my cummulative average...

Cumulative monthly stats

Day-to-day trade log

Thursday 9/18/2014...2/1 1BE...+25 or +$100

Wednesday 9/17/2014...5/6...+36 or +$288

Was doing well until I was afflicted with a brain cramp!

4 losing trade in a row...

A WAG on a pattern...

Tuesday 9/16/2014...4/2...+46 or +$345

Monday 9/15/2014...3/3 1 BE...+17 or +$95

Might have been better off sticking with the RLM.

Good signals began to fail...divergences and TLBs then a 2B

Friday 09/12/2014...5/3...+26 or +$109

Symbol roll-over...relentless down so far today

Thursday 09/11/2014...2/2 1BE...+36 or +$149

Wednesday 09/10/2014...2/0...+16 or +$93

Saw very little to trade on untill the EOD

Tuesday 09/09/2014...2/2 1 BE...+8 OR -$4

Monday 09/08/2014...1/1 1 BE...+9 or +$22

Friday 09/05/2014...6/2...+47 or +$185

Trailed a buy-stop down using the TL, starting @ 17046

Thursday 09/04/2014...2/1...+25 or +$103

Traded the YM today...got a bit 'lucky' on the last one.

The idea was to play a possible MOF/Sling or 2B after the divergence at the lows and the new HH printed...

But price did not dip below the WMA by enough to make me place the order...

So I kept watching and bought on the TLB figuring the MOF had printed and the new trend was beginning.

Wednesday 09/03/2014...3 wins 1BE...+20 or +$174

Tuesday 09/02/2014...3/1...+22 or +$153

Using the TL, Buy-Stop above price looking for a TLB.....+ $54...RLM

Took quite a few more trades than last month...Ave. Win % was down but my bottom line was reasonable

because trading the RUT and ES kept the Tick Win/Loss ratio up...

Ave. Win % w/o BE trades was still good but below my cummulative average...

Day-to-day trade log

Day and date header...number of winning/losing trades...total point gain/loss and dollar amount

(Daily summary includes commissions and assumes one contract per trade)

Every B/E or -1 tick stop-out may not be included. I prefer having the trades that worked available for review

unless there's something important to be gained by looking at those that did not

(like pointing out poor trade decisions so I can try not to repeat them).

Usually I include two charts of each trade; one that captures what I saw as entry rationals and another for the results.

Every B/E or -1 tick stop-out may not be included. I prefer having the trades that worked available for review

unless there's something important to be gained by looking at those that did not

(like pointing out poor trade decisions so I can try not to repeat them).

Usually I include two charts of each trade; one that captures what I saw as entry rationals and another for the results.

Tuesday 09/30/2014...1/2..1 BE...0 or -$25 (commissions)

Not the best signals but I'll take it.

Monday 09/29/2014...0/1...-4 or -$26

Last Monday of the month - Larry Williams says to expect bullish P/A

Great price action and ranges...just was seeing a lot of signals fail...

Friday 09/26/2014...1/1...+9 or +$78

A good start

Same as above but with commentary

Gave some back looking for a 3:30 reversal that never came

Thursday 09/25/2014...1/3 2BE...-8 or -$92

Not the best way to start the day. Pre-MMO with 2 stop-outs and a small gain...

Good signals failed to produce pops to my upper bracket target.

Trend is relentless - down...good signals still failing

2 trades...1 for -3 and 1 BE

Wednesday 09/24/2014...4/1...+32 or +$234

A mix of ES, YM and NQ trades today

Pre-MMO trades, +1 for 2 for a net +$50

-2 ticks or -$31 after commissions

+7 ticks or +$81 after commissions

Major markets have been open about an hour...+9 ticks or +$106

Continuing to have a good day...+8 or +$34

+10 or +$44 after commissions...tried to loosen up my stop to let it run but was getting pretty volatile...

Tuesday 09/23/2014...2/4...+10 or +$20

Better than losing...last week's ATHs followed by a down trend this week.

Coulda-Shoulda-Woulda...

Monday 09/22/2014...3/3 2-BE... +13 or +$30

Did a lot of trading but net was smallish due to commissions.

Friday 9/19/2014...2/0...+12 or +$48

The trade above: Markets are much slower paced before the majors open at 9:30...

This trade was placed at 8:14 and took 15 minutes to capture 10 ticks...

By 8:54 price had continued up to 17253 with no more than a 5 tick pull-back...

As shown below, even though a lot was left on the table, you just never know for sure when they'll run.

Tried to play the reversal at the measured move but it didn't run...

Thursday 9/18/2014...2/1 1BE...+25 or +$100

Good entry signals on both TFs...sold too early

Wednesday 9/17/2014...5/6...+36 or +$288

Was doing well until I was afflicted with a brain cramp!

4 losing trade in a row...

A WAG on a pattern...

Tuesday 9/16/2014...4/2...+46 or +$345

Monday 9/15/2014...3/3 1 BE...+17 or +$95

Might have been better off sticking with the RLM.

Good signals began to fail...divergences and TLBs then a 2B

Another 2B but not a great one

Friday 09/12/2014...5/3...+26 or +$109

Symbol roll-over...relentless down so far today

As the longer term charts filled in it became a bit easier to see possibilities...

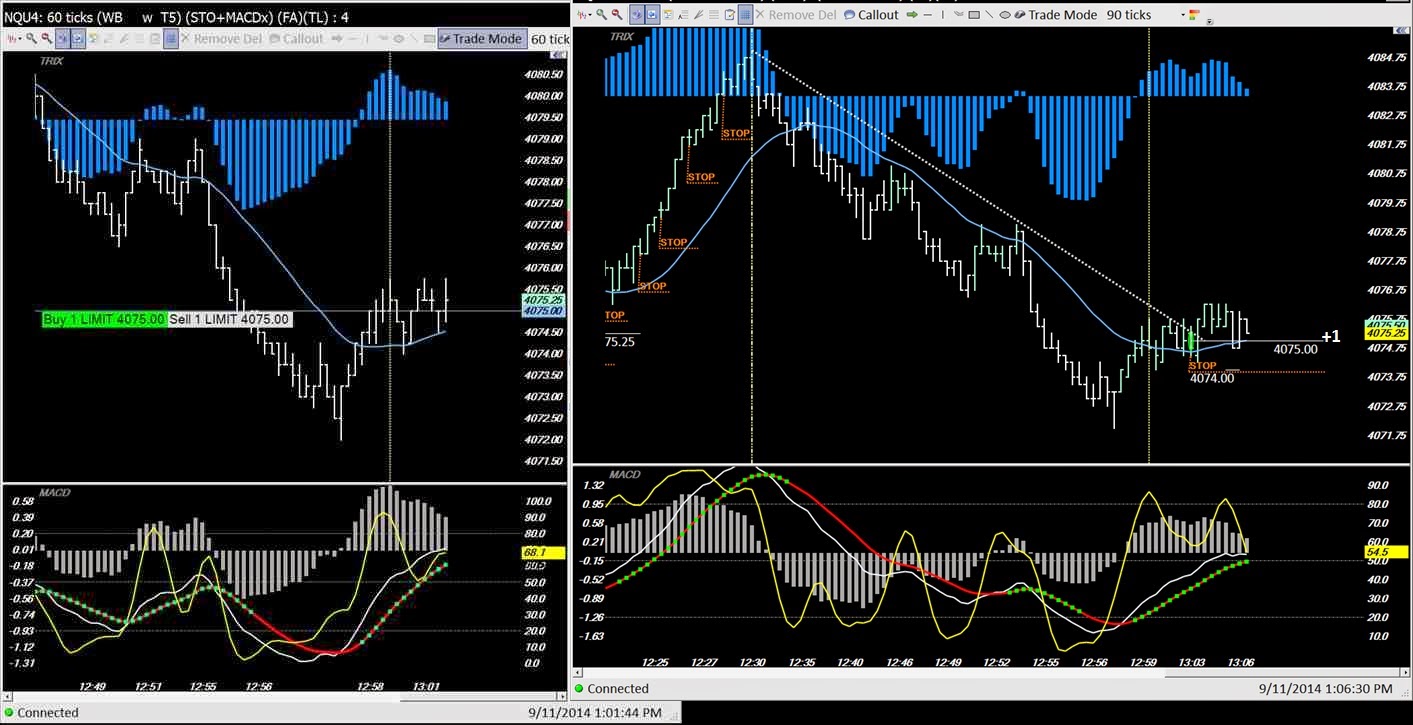

Thursday 09/11/2014...2/2 1BE...+36 or +$149

Wednesday 09/10/2014...2/0...+16 or +$93

Saw very little to trade on untill the EOD

Tuesday 09/09/2014...2/2 1 BE...+8 OR -$4

Difficult day so far...few divergence plays, wide bar ranges and little follow through.

Monday 09/08/2014...1/1 1 BE...+9 or +$22

Friday 09/05/2014...6/2...+47 or +$185

Trailed a buy-stop down using the TL, starting @ 17046

Thursday 09/04/2014...2/1...+25 or +$103

Traded the YM today...got a bit 'lucky' on the last one.

Another 2B but I was late to spot it

I started out thinking a buy-stop above the WMA would be the way to trade the set up shown below (a low-risk order).The idea was to play a possible MOF/Sling or 2B after the divergence at the lows and the new HH printed...

But price did not dip below the WMA by enough to make me place the order...

So I kept watching and bought on the TLB figuring the MOF had printed and the new trend was beginning.

Wednesday 09/03/2014...3 wins 1BE...+20 or +$174

Tuesday 09/02/2014...3/1...+22 or +$153

Using the TL, Buy-Stop above price looking for a TLB.....+ $54...RLM

Using the TL, Limit order below price at TLB looking for a RE-Test.... + $39...YM

Using patterns and the TL, Buy-Stop above price looking for a slingshot TLB.... + $106...RLM

Good divergence signals failed....- $46...RLM

Missed...