JULY 2014 Trade Statistics and activity

Excellent Win % for July...was up even though Ave. # of Wins/day was down. I took about the same

number of trades month-over-month but my Win/Loss ratio increased...

July EOM Summary Charts

***********************

July Daily trade Charts

Excellent Win % for July...was up even though Ave. # of Wins/day was down. I took about the same

number of trades month-over-month but my Win/Loss ratio increased...

July EOM Summary Charts

***********************

July Daily trade Charts

Day and date header...number of winning/losing trades...total point gain/loss and dollar amount

(Daily summary includes commissions and assumes one contract per trade)

Every B/E or -1 tick stop-out may not be included. I prefer having the trades that worked available for review

unless there's something important to be gained by looking at those that did not

(like pointing out poor trade decisions so I can try not to repeat them).

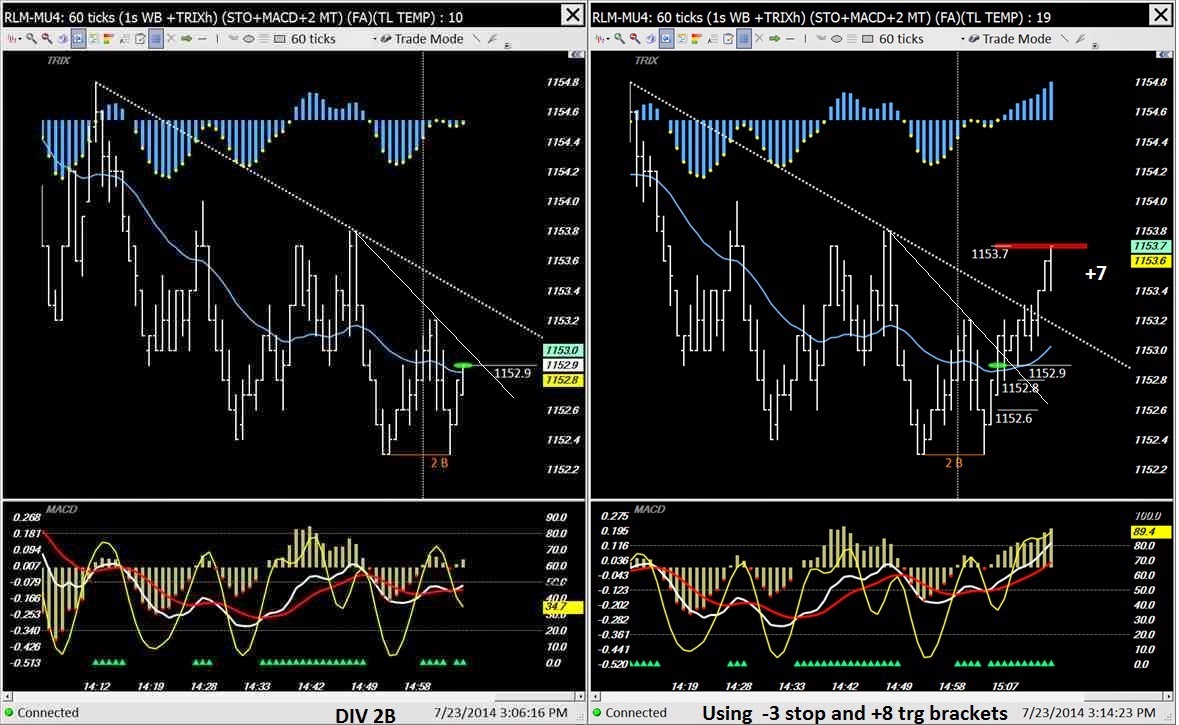

Usually I include two charts of each trade; one that captures what I saw as entry rationals and another for the results.

__________________________________________________

Thursday 07/31/2014...2/0...+30 or +$288

It matters not whether its an up or down market, P/A is P/A...

Wednesday 07/30/2014...1/0...+10 or +$94

My regular bread & butter trade signals...old reliables - divergences and trend line breaks

Tuesday 07/29/2014...0/1...-3 or -$36

Monday 07/28/2014...1/0...+9 or +$84

Friday 07/25/2014...2/1 1BE...+25 or +$236

Thursday 07/24/2014...2/0...+12 or +$108

Wednesday 07/23/2014...2/1...+16 or +142

Tuesday 07/22/2014...no trades

Missed a few today by having my limit entry too low but signals were sparse and less than 'great'...

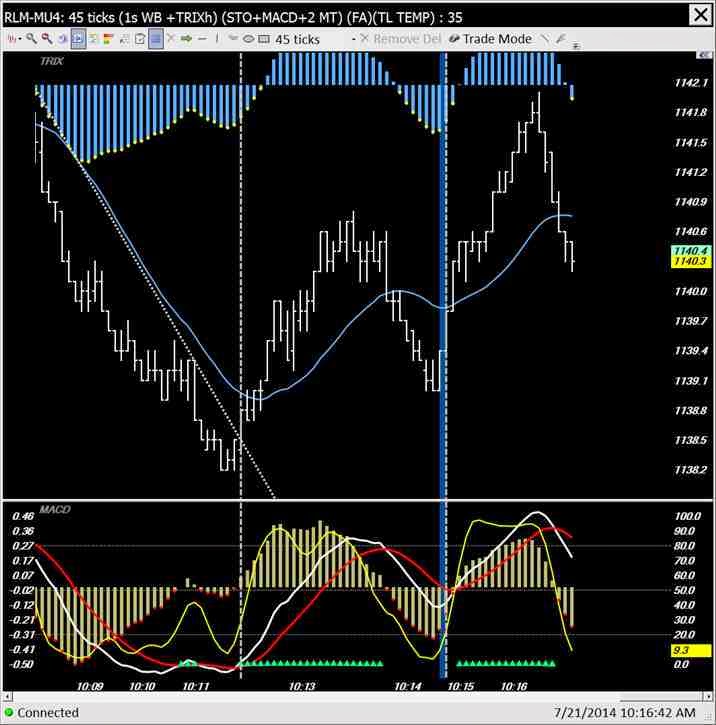

Monday 07/21/2014...no trades

Test trades did not inspire confidence this morning...missed some possible entries too.

Friday 07/18/2014...0/1...-3 or -$36

Choppy price action - signals were not clear...Yesterday's drop was completely reversed today.

Thursday 07/17/2014...4/2...+22 or +$202

Very active down day, even after lunch

Very active pace going into lunch - too quick for me...taking a coffee break...

but

Lunchtime just about over...still very active

When good signals fail...stay away.

Giving back a good day's trades, bit by bit...

Wednesday 07/16/2014...no trades

Tuesday 07/15/2014...1 BE...-$16

Lots of signals today...I just was late seeing them...other charts w/notes below the BE trade chart.

Some "Coulda-Shoulda" examples that were available today...

Monday 07/14/2014...5/2/1BE...+37 or +$342

Better off with the RLM, seem to have a handle on it vs. the YM

Friday 07/11/2014...3/1...+17 or +$130

Thursday 07/10/2014...0/1...-2 or -$16

I missed a few good ones today and caught a bad one...

Wednesday 07/09/2011...4/0...+27 or +$111

A good day at the office

Tuesday 7/08/2014...1/1...+5 or +$13

Monday 7/07/2014...1/1/1 BE...+6 or +$18

Narrow ranges made for sparse trading opportunities. The early test trades told me to try the YM today as the RLM was more choppy...

TEST TRADE

Cancelled the order...

Thursday 7/3/2014...no trades

Wednesday 7/02/2014...0/2...-4 or $52

There were many reversals but W/O good signals today. Choppy sessions except for the RLM...it responded

to the H&S and trended down all day, giving back almost all of yesterday's session gain.

Tuesday 7/01/2014...1/0...+9 or +$84

First a couple of TEST trades and then it was finally time to take money from the market.

Trying out using Trade Mode with the slightly longer time frame and using the quicker chart for trend line and level annotations.

I am liking the simple red MACD Trend lines in the studies so far... they print when the EMAs cross down

and the histo is under the zero line...they sometimes help me see divergences.

Every B/E or -1 tick stop-out may not be included. I prefer having the trades that worked available for review

unless there's something important to be gained by looking at those that did not

(like pointing out poor trade decisions so I can try not to repeat them).

Usually I include two charts of each trade; one that captures what I saw as entry rationals and another for the results.

__________________________________________________

Thursday 07/31/2014...2/0...+30 or +$288

It matters not whether its an up or down market, P/A is P/A...

Wednesday 07/30/2014...1/0...+10 or +$94

My regular bread & butter trade signals...old reliables - divergences and trend line breaks

Tuesday 07/29/2014...0/1...-3 or -$36

Monday 07/28/2014...1/0...+9 or +$84

Friday 07/25/2014...2/1 1BE...+25 or +$236

Thursday 07/24/2014...2/0...+12 or +$108

Wednesday 07/23/2014...2/1...+16 or +142

Tuesday 07/22/2014...no trades

Missed a few today by having my limit entry too low but signals were sparse and less than 'great'...

Monday 07/21/2014...no trades

Test trades did not inspire confidence this morning...missed some possible entries too.

Friday 07/18/2014...0/1...-3 or -$36

Choppy price action - signals were not clear...Yesterday's drop was completely reversed today.

Thursday 07/17/2014...4/2...+22 or +$202

Very active down day, even after lunch

Very active pace going into lunch - too quick for me...taking a coffee break...

but

Lunchtime just about over...still very active

When good signals fail...stay away.

Giving back a good day's trades, bit by bit...

Wednesday 07/16/2014...no trades

Tuesday 07/15/2014...1 BE...-$16

Lots of signals today...I just was late seeing them...other charts w/notes below the BE trade chart.

Some "Coulda-Shoulda" examples that were available today...

Monday 07/14/2014...5/2/1BE...+37 or +$342

Better off with the RLM, seem to have a handle on it vs. the YM

Friday 07/11/2014...3/1...+17 or +$130

Thursday 07/10/2014...0/1...-2 or -$16

I missed a few good ones today and caught a bad one...

Wednesday 07/09/2011...4/0...+27 or +$111

A good day at the office

Tuesday 7/08/2014...1/1...+5 or +$13

Monday 7/07/2014...1/1/1 BE...+6 or +$18

Narrow ranges made for sparse trading opportunities. The early test trades told me to try the YM today as the RLM was more choppy...

TEST TRADE

Cancelled the order...

Independence Day !

Friday July 4th...Thursday 7/3/2014...no trades

Wednesday 7/02/2014...0/2...-4 or $52

There were many reversals but W/O good signals today. Choppy sessions except for the RLM...it responded

to the H&S and trended down all day, giving back almost all of yesterday's session gain.

Tuesday 7/01/2014...1/0...+9 or +$84

First a couple of TEST trades and then it was finally time to take money from the market.

Trying out using Trade Mode with the slightly longer time frame and using the quicker chart for trend line and level annotations.

I am liking the simple red MACD Trend lines in the studies so far... they print when the EMAs cross down

and the histo is under the zero line...they sometimes help me see divergences.