April 2014 trade summary, statistics and comments

Poor results showing for the Ave. Win % but not too shabby otherwise...

there were increases in Ave. Point Gain on Winners and Tick Win/Loss but not much of an increase to the bottom line this month.

Cummulative monthly statistics

Daily trade statistics

April EOM Summary Charts

__________________________________________________

04/30/2014...3/3...+10 or +$40

Testing whether I like the automatic entry/exit flag feature available with the Apextrader software...

The chart below has them for my 1st three trades this morning - showing two stop outs and 1 gainer...

The flags showing on the chart above are for these next three trades...

Other trades taken:

04/29/2014...1/1...+5 or +$1

A 'blah' day for trading. The few signals that fired did not provide much follow through.

The first set of charts below shows how long it took (30 minutes??) for a decent trade to happen - I did not take this one...

I did take these two...

04/28/2014...Monday...no trades

Testing the Awesome Oscillator today...

It works very much like the TRIX histogram (smooth) but the color change helps with early ID of divergence.

There are other more subtle differences that may prove useful as I become acclimated to the indicator...

1st two charts - DIV SLINGs - comparing the Awesome Osc. to the TRIX histo...

And here are two charts with MOF entry levels highlighted...

04/25/2014...Friday...no trades

Signals were not firing and P/A was kinda jumpy...Looking at the 1 minute DOW chart

you would think that there were many opportunities - I did not see any.

DOW 60 minute chart shows the month so far with 1 minute charts on the right.

Added $TICK (NYSE) chart today.

04/24/2014...Thursday...2/1 1BE...+18 or +$66

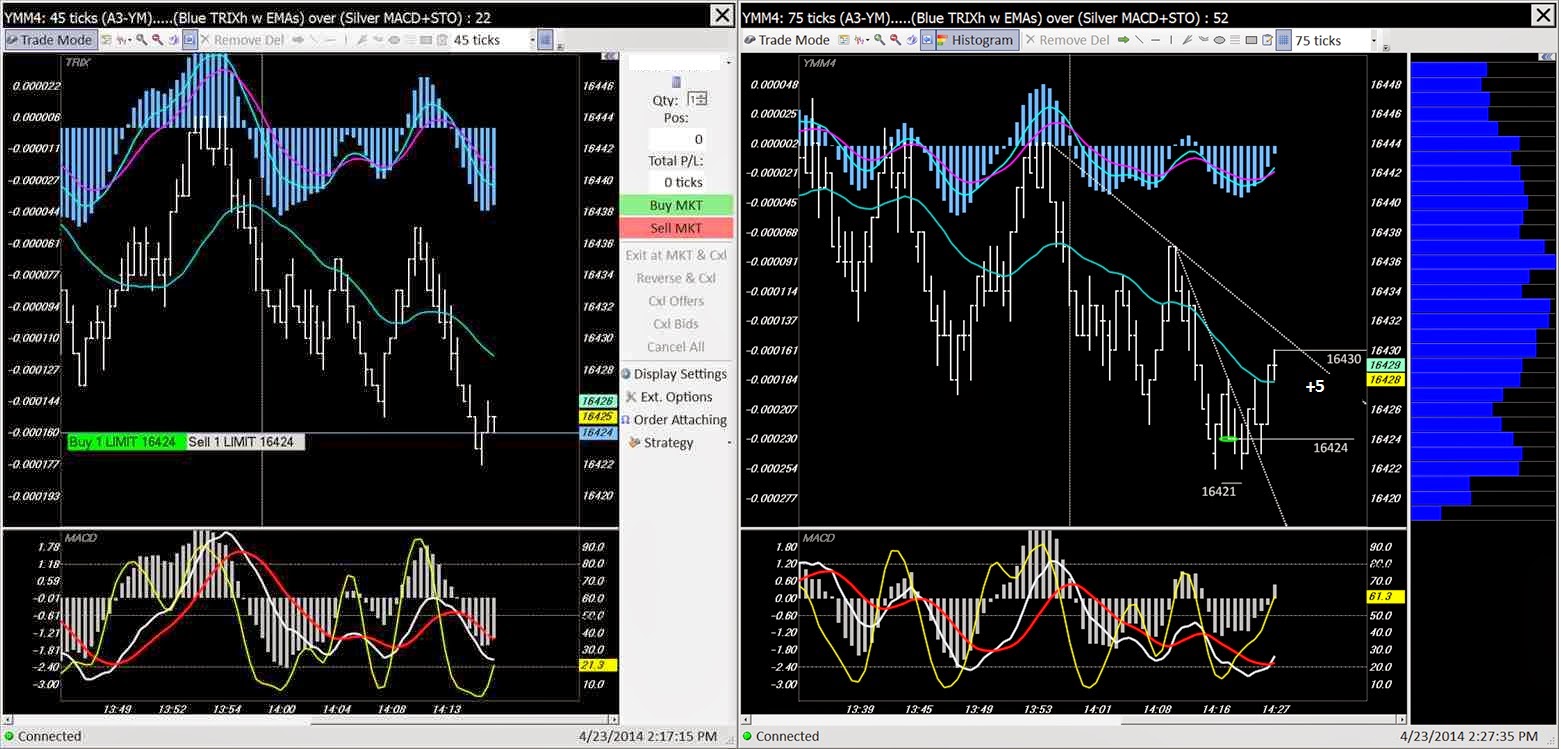

04/23/2014...Wednesday...3/2...+12 or +$30

04/22/2014...Tuesday...1/2...+1 or -$13

Saw this continuation sling on the chart above before taking the next one and

was looking for the same result...but not this time...

04/21/2014...Monday...1/3...+10 or +$32

Very few good entry signals today and very light activity in all the FUTs...

First two trades were simple TLB plays. The 3rd chart shows a missed 2B play.

I missed a few other trades by 1 or 2 ticks using Limit orders below the current price action.

The trade above was a good recovery from the mornings losses but I'm not sorry about taking the gain when I did.

(well, maybe I'm engaging in a little "coulda-shoulda-woulda" lamenting)

Anyway, sometimes they just run into the major market's close...

04/17/2014...Thursday...4/1 and 1BE...+34 or +$130

Good Friday is tomorrow

Took a lot of quick scalps before lunch time...no trades after lunch.

04/16/2014...Wednesday...2/1 and 1 BE...+13 or +$40

04/15/2014...Tuesday...3/0...+37 or +$167

Very nice set of trades. The first two I just let the upper stop get hit. With the last trade, I upped it twice then took the add'l 7 ticks.

The trade above continued to run after I took gains...

04/14/2014...Monday...1/1...+24 or +$114

You don't need to take a lot of trades to have a nice day.

This was a good trade although it continued up towards 16,100 after I took my leave...

The SDS option trade has been messing me up...having been down far more dollars

than I should have allowed then coming back to B/E and a bit above.

And now, with only one left it could expire worthless without affecting my bottom line.

04/10/2014...Thursday...no trades*

Was expecting another up day, at least to get into the Brach Zone retrace area of the sell off. from last Friday-Monday...

Having any preconceived directional bias like this makes it tougher to concentrate on the little scalps I take...

*I did sell one more little SDS call contract to get to Happy Meal status.

Still have 2 contracts and 6 days to get to real meal status

04/09/2014...Wednesday...1/0...+10 or +$94

04/08/2014...Tuesday...1/2 and 1 BE...+22 or +$92

Only 1 winning trade out of 4 but still a nice profit.

04/07/2014...Monday...no trades

Straight down again today

Leaders...

04/03/2014...Friday...no trades**

** Hail Mary trading

or how NOT to trade options...or anything else

04/03/2014...Thursday...0/1...-4 or -$26

Feeling a little under the weather today so decided to take the rest of the day off.

Checking back later, even my break-time timing is off...

It's easy to spot them after the fact...but there will always be another trade.

04/02/2014...Wednesday...0/2...-8 or -$52

There were several trend trades available today.

there were increases in Ave. Point Gain on Winners and Tick Win/Loss but not much of an increase to the bottom line this month.

Cummulative monthly statistics

Daily trade statistics

April EOM Summary Charts

__________________________________________________

April Daily trade Charts

The dates and days headers are followed by the number of winning/losing trades, then

the point gain/loss per contract and the dollar amount for the day.

the point gain/loss per contract and the dollar amount for the day.

(The calculation includes commissions and assumes only 1 contract was taken per trade)

Please understand that ALL my B/E or small stop-outs may not be included here.

I prefer to have my winning trades available for review unless there's something important to be gained by looking at the losses

(like pointing out poor trade decisions so I can try not to repeat them)

__________________________________________________

Please understand that ALL my B/E or small stop-outs may not be included here.

I prefer to have my winning trades available for review unless there's something important to be gained by looking at the losses

(like pointing out poor trade decisions so I can try not to repeat them)

__________________________________________________

04/30/2014...3/3...+10 or +$40

Testing whether I like the automatic entry/exit flag feature available with the Apextrader software...

The chart below has them for my 1st three trades this morning - showing two stop outs and 1 gainer...

The flags showing on the chart above are for these next three trades...

Other trades taken:

04/29/2014...1/1...+5 or +$1

A 'blah' day for trading. The few signals that fired did not provide much follow through.

The first set of charts below shows how long it took (30 minutes??) for a decent trade to happen - I did not take this one...

I did take these two...

04/28/2014...Monday...no trades

Testing the Awesome Oscillator today...

It works very much like the TRIX histogram (smooth) but the color change helps with early ID of divergence.

There are other more subtle differences that may prove useful as I become acclimated to the indicator...

1st two charts - DIV SLINGs - comparing the Awesome Osc. to the TRIX histo...

And here are two charts with MOF entry levels highlighted...

04/25/2014...Friday...no trades

Signals were not firing and P/A was kinda jumpy...Looking at the 1 minute DOW chart

you would think that there were many opportunities - I did not see any.

DOW 60 minute chart shows the month so far with 1 minute charts on the right.

Added $TICK (NYSE) chart today.

04/24/2014...Thursday...2/1 1BE...+18 or +$66

04/23/2014...Wednesday...3/2...+12 or +$30

04/22/2014...Tuesday...1/2...+1 or -$13

Saw this continuation sling on the chart above before taking the next one and

was looking for the same result...but not this time...

04/21/2014...Monday...1/3...+10 or +$32

Very few good entry signals today and very light activity in all the FUTs...

First two trades were simple TLB plays. The 3rd chart shows a missed 2B play.

I missed a few other trades by 1 or 2 ticks using Limit orders below the current price action.

The trade above was a good recovery from the mornings losses but I'm not sorry about taking the gain when I did.

(well, maybe I'm engaging in a little "coulda-shoulda-woulda" lamenting)

Anyway, sometimes they just run into the major market's close...

04/17/2014...Thursday...4/1 and 1BE...+34 or +$130

Good Friday is tomorrow

Took a lot of quick scalps before lunch time...no trades after lunch.

04/16/2014...Wednesday...2/1 and 1 BE...+13 or +$40

04/15/2014...Tuesday...3/0...+37 or +$167

Very nice set of trades. The first two I just let the upper stop get hit. With the last trade, I upped it twice then took the add'l 7 ticks.

The trade above continued to run after I took gains...

04/14/2014...Monday...1/1...+24 or +$114

You don't need to take a lot of trades to have a nice day.

This was a good trade although it continued up towards 16,100 after I took my leave...

04/11/2014...Friday...0/3...-12 or -$78

My timing is STILL offThe SDS option trade has been messing me up...having been down far more dollars

than I should have allowed then coming back to B/E and a bit above.

And now, with only one left it could expire worthless without affecting my bottom line.

04/10/2014...Thursday...no trades*

Was expecting another up day, at least to get into the Brach Zone retrace area of the sell off. from last Friday-Monday...

Having any preconceived directional bias like this makes it tougher to concentrate on the little scalps I take...

*I did sell one more little SDS call contract to get to Happy Meal status.

Still have 2 contracts and 6 days to get to real meal status

04/09/2014...Wednesday...1/0...+10 or +$94

04/08/2014...Tuesday...1/2 and 1 BE...+22 or +$92

Only 1 winning trade out of 4 but still a nice profit.

04/07/2014...Monday...no trades

Straight down again today

Leaders...

04/03/2014...Friday...no trades**

** Hail Mary trading

or how NOT to trade options...or anything else

04/03/2014...Thursday...0/1...-4 or -$26

Feeling a little under the weather today so decided to take the rest of the day off.

Checking back later, even my break-time timing is off...

It's easy to spot them after the fact...but there will always be another trade.

04/02/2014...Wednesday...0/2...-8 or -$52

There were several trend trades available today.

04/01/2014...Tuesday...2/0...+23 or +$103

Nice way to start the month.

A trend line break re-test trade rational ...very similar P/A as the previous trade but...Oops...